5 Ways to Modernize Your Next Recordkeeper RFP

Posted by Robbie Bristow, AIF®, Director of Product Strategy on August 16, 2019

For many advisors, recordkeeper RFPs conjure up thoughts of endless amounts of documents, countless back-and-forth conversations with candidates, and immense amounts of effort and time. While it’s true that recordkeeper RFPs are an involved process that requires a generous amount of effort, many advisors fail to take certain steps to help expedite and modernize their RFP process.

RFPs have come a long way from the days of phone calls, sending letters and receiving binders of documents and collateral from recordkeepers. With the availability of technology to facilitate the RFP process and evolution in capabilities from recordkeepers, a modern RFP process is within reach!

To help you form a better recordkeeper RFP process, here are five ways you can modernize your next RFP. Whether you are looking for a gut check on your current RFP process, or you’re establishing a process for the first time, these tips will help ensure you provide a quality service for your clients as efficiently as possible.

1) Set Clear Timelines and Expectations

An efficient recordkeeper RFP starts with a solid foundation. Specifically, this means setting clear timelines and expectations with your client.

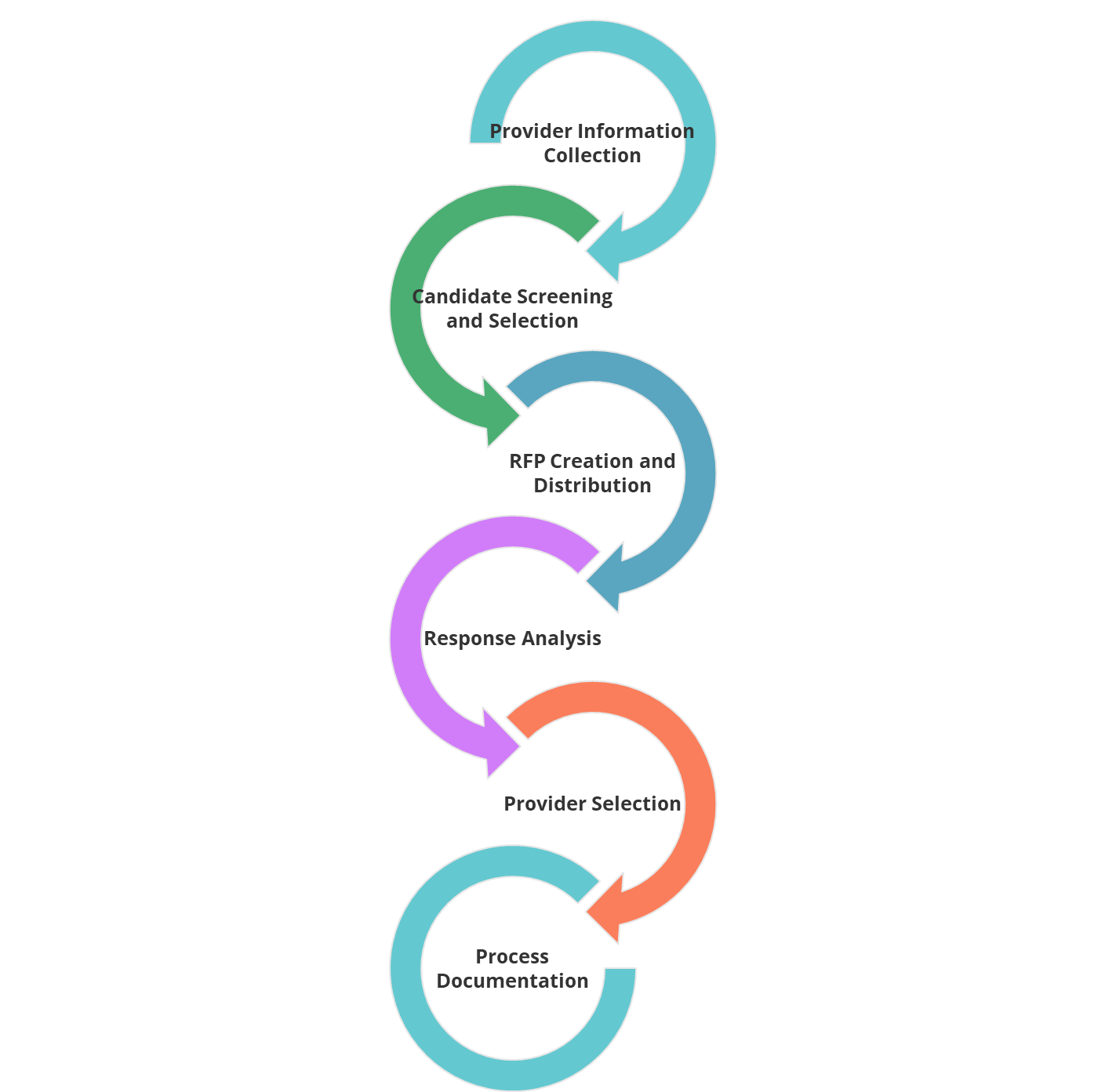

First, establish an RFP process workflow that lays out the key stages and milestones. This plan will aid you in communicating and setting expectations on what is involved with the collective RFP process. An example of the stages of an RFP process plan are below:

- Define Timelines

- Gather Key Requirements and Objectives

- Evaluate and Select Providers for Invitation

- Create and Distribute the RFP

- Answer Questions and Receive Proposals

- Evaluate and Score Responses

- Hold Finalist Presentations

- Finalist Evaluation and Decision

- Implementation

Prior to reviewing the plan, define who on your client’s team will be involved with the RFP process. One way to make sure all voices are heard is to form a sub-committee that includes finance, human resources and other key staff so their needs are considered.

Review your plan with your client’s team to ensure there is a shared understanding of how the process will go. This is also the point to establish timelines that will work for your client. Aim to set a timeline that allows sufficient time to complete the process but not so long that focus on reaching a decision is lost.

2) Determine What is Most Important to Your Client

As most retirement plan advisors understand, no two clients are the same! Given that fact, it’s important to make sure your client’s specific needs are clear and defined before embarking on the recordkeeper RFP journey.

A good first step in defining your client’s key priorities is to review any issues with the current recordkeeper. By doing a thorough analysis of the current recordkeeper’s short-comings, you can start to define priorities for the outcome of the RFP process.

Depending on the members of your client’s team that are involved with the RFP process, you will likely encounter a number of specific services or needs that your client will want considered in the RFP. This can be everything from reducing administrative burdens, mitigating costs and fiduciary liability for the employer, improving retirement outcomes, or adding new technology services.

By going through this process, you can help your client refine their needs into what’s most important. With that information in hand you can effectively translate these details into your RFP process -- more on that later!

3) Don’t Invite Everybody to The Party!

One of the most common mistakes that advisors make in the RFP process is inviting too many candidates to respond. As the old adage says, quality over quantity. Inviting too many candidates creates a mountain of extra effort for you and your client, for little added value.

Recordkeepers are not one size fits all, and many specialize in services that will make specific candidates a better fit for your client. Like with all things fiduciary related, establishing a process is critical.

Create a framework for candidate selection that is based on evaluating critical factors of the recordkeeper’s services, relative to the needs of your client. Following this process will allow you to screen a broad segment of recordkeepers, and then whittle the list down to the best candidates for your client. An example of factors to consider are below:

- Background & Experience

- How many plans does the recordkeeper currently support that are similar to your client’s plan size?

- What is the average number of participants per plan for which the recordkeeper provides daily valuation recordkeeping services?

- Plan Services

- Does the recordkeeper provide annual benchmarking / reviews?

- Does the recordkeeper support customization of participant statements?

- Participant Services

- Is online account management and statement access available?

- Are Spanish-speaking support representatives available?

- Investment Options

- Does the recordkeeper offer 3(21) and/or 3(38) services?

- Does the recordkeeper offer ESG investment options?

- Conversion & Implementation

- Does the recordkeeper support recordkeeping of a put on a Stable Value Fund?

- Is a phone line or website available for participants to access throughout the conversion?

As an example, Fi360’s RFP Director toolset provides a candidate screening feature for just this purpose. In the workflow of configuring your RFP, RFP Director allows you to create a list of screening criteria and evaluate recordkeepers utilizing survey data that is pre-collected. You can then save your screening criteria and use it as a template for future RFPs.

4) Share Specific and Detailed Instructions

When it comes to RFPs, being detailed and explicit yields the best outcomes.

When recordkeepers receive an RFP request, there is a general understanding of what is being requested and how to proceed. However, if you do not provide sufficient details about the request and the client’s specific needs, the proposal you receive might not be what you expected.

A critical best practice is to provide recordkeepers with specific and detailed instructions with each RFP. An easy way to do this is to create an RFP Instructions template that ensures you share key information with recordkeepers. By sending clear instructions to recordkeepers you will ensure you receive a tailored proposal that suits your client.

There are many elements you could include in your RFP Instructions. Below are a few examples:

- Share background on the client, their current challenges and needed solutions.

- Specify how services and pricing should be constructed.

- Specify any investment menu requirements or limitations, such as including a stable value fund or utilizing the client’s existing investment lineup.

- Define the format in which the proposal should be sent.

- Clarify any critical services or factors that must be included in the proposal.

5) Have a Framework for Evaluating Proposals

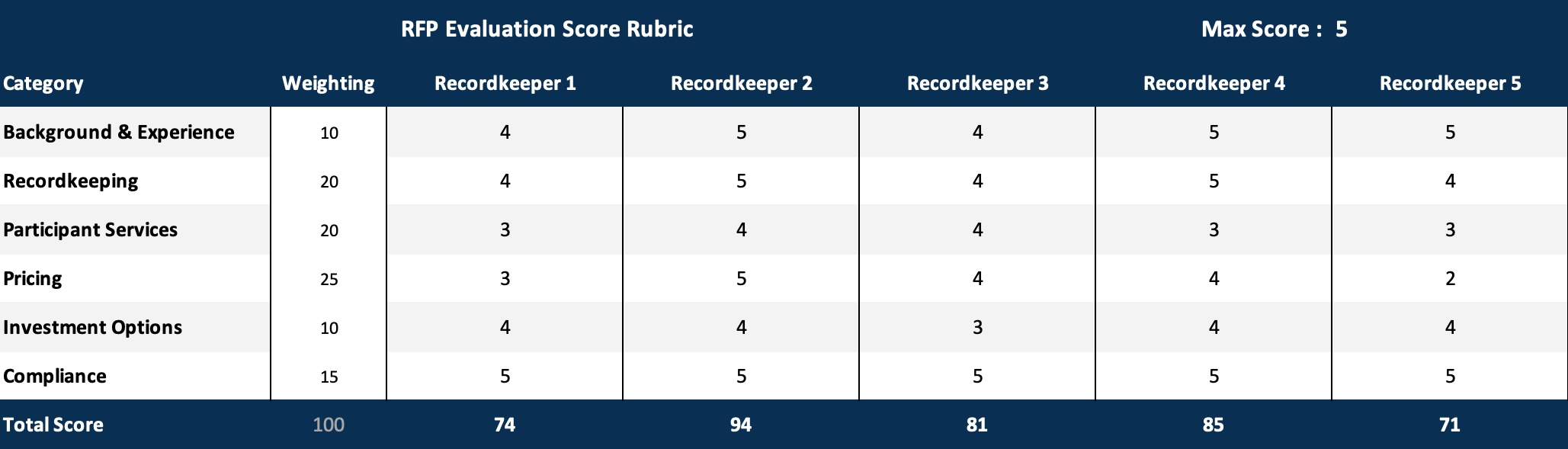

When all of the proposals come in for your RFP, it can seem overwhelming to assimilate the details and put together a fair and coherent analysis for your client. One way to streamline how the assessment is conducted is to create a framework that allows you to objectively evaluate each candidate’s proposal.

Creating a rubric to score and evaluate recordkeeper responses can be very effective. A simple way to construct your scoring rubric is to define the broad categories you wish to evaluate, set a weighting for each category based on your client’s priorities, and then score each proposal. It’s wise to gather your client’s input on the score weighting in advance.

A scoring rubric template can be downloaded here

In addition to scoring each recordkeeper’s proposal, documenting a paragraph or two of notes is recommended. Taking this step can help clarify the basis for each recordkeeper’s score and provide context.

After going through the scoring exercise, you can use the proposal scores to augment the final decision process and to enrich your RFP documentation.

Conclusion

Whether it’s your first RFP ever, or if you’re a seasoned veteran, looking for ways to modernize your RFP process pays dividends. Those dividends come in the form of reduced effort, a scalable / repeatable process and better outcomes for your clients.

If you’re looking for a solution to aid you in modernizing your RFP process, Fi360’s RFP Director toolset is designed to do just that. We have helped retirement plan advisors conduct over 6,000 service provider RFPs, ranging from start-ups to $10 billion plans.

Have you found other ways to modernize your RFP process? Have any other tips for improving RFP outcomes? If so, please send me an email with your thoughts and feedback – I would love to hear from you!

ICYMI - Aug. 2, 2019

Posted by Fi360 on August 02, 2019

Fi360 is Accredited!

The most exciting news we have shared since our last ICYMI blog post is the accreditation of Fi360 for the Accredited Investment Fiduciary® (AIF®) Designation by the ANSI National Accreditation Board (ANAB).

Everything is Bigger in Texas

Including the 2020 Fi360 Conference! Registration for the premier event for investment fiduciaries and financial services professionals opened just last week. Join us in Austin, TX, May 17 – 19 for the best fiduciary conference, as ranked by Nerd’s Eye View on Kitces.com.

August Webinar - Step 2 of the Fiduciary Process: Formalizing the Investment Strategy*

Join Fi360's Rich Lynch, AIFA®, director, and Bennett Aikin, AIF®, vice president of designations, for an overview of the prudent process an advisor should follow to arrive at a proper investment allocation strategy to best suit the needs of the investor. This session is appropriate as both an introduction to fiduciary responsibility for those who are inexperienced with acting as a fiduciary and as a refresher for experienced advisors who have fiduciary training and a track record of supporting fiduciary clients.

*This webinar is accepted for one hour of continuing education by Fi360, CFP Board and IWI.

Articles of Interest

DOL rule enables small businesses to offer retirement plans through trade associations

State Fiduciary Rules on a 'Collision Course' With Reg BI: Lawyers

Mario Giganti of Cornerstone Capital Advisors + Fi360

Posted by Fi360 on July 19, 2019

“That’s where I believe Fi360 has been transformational. Its impact on other advisors and the fiduciary industry and most importantly the retirement plan industry has been most profound.”

It's quite possible that Mario Giganti, CPA, CFP®, AIFA®, president and senior advisor at Cornerstone Capital Advisors, is one of Fi360's original super fiduciaries. He and his team have been using the Fi360 Toolkit™ from the jump. Mario has never missed an Fi360 Conference. And it just so happens he is one of our adjuct faculty for the AIF® Designation Training program.

Learn how Mario and his team use Fi360's education and software to pursue fiduciary excellence on behalf of their clients.

ICYMI - June 28, 2019

Posted by Fi360 on June 28, 2019

NEW Fi360 Webinars Are Live

Since our last ICYMI blog post, we have hosted both the "Reg BI Cometh!" and "What Crayola Color of 3(16) Does Your Vendor Provide?". You can now watch those webinars at your convenience through our Webinars page.

And don't miss our July webinar, sponsored by American Funds:

Health Meets Wealth: What Role Do Health Savings Accounts (HSAs) Play in Retirement Investing?*

Thursday, July 11 at 2:00 p.m. ET

Register Now

Hiring Strategies in a Tight Labor Market

According to Matt Burt, director of professional services at Fi360, plan consultants typically evaluate capacity, financial impact and workload when they consider adding staff. Fi360’s surveys have found that taking on 25 new plans is one commonly used metric, as is the projection of $250,000 to $275,000 in additional annual revenue. Timing a hiring decision can be more art than science, Burt cautions, but lately, financial indicators have become more influential in advisors’ decisions.

Check out the full article on WealthManagement.com.

Industry Digs In as Reg BI, Advice-Standards Package Arrives

The industry continues to buzz about the SEC's June 5 meeting, where among other things, they released their Regulation Best Interest rule package. Blaine Aikin, executive chairman at Fi360, recently spoke with Melanie Waddell at ThinkAdvisor, saying that Reg BI “does raise the suitability standard a bit higher than it is today for broker-dealers.”

That said, however, Aikin sees the entire advice package as weakening investor protections. Reg BI “cannot be considered in isolation; the other three parts of the regulatory package are intertwined with Reg BI. Taken together, the package must be viewed as a setback for investor protection and for the profession of investment advice,” he said.

Get the full rundown on ThinkAdvisor.

SEC Reg BI - Fi360 Overview and Commentary

The SEC's advice-standards package clocks in at about 1,000 pages, 771 of which are taken up by Reg BI. Fi360's experts have read every word and dissected it for you. Download the white paper to get a clear analysis of what the Reg BI package means as viewed through a fiduciary lens.

*This webinar is accepted for one hour of continuing education by Fi360, CFP Board and IWI.

All Things Fiduciary

Posted by Kathleen M. McBride, AIFA®, Founder, Fiduciarypath, LLC on June 21, 2019

This article originally appeared in the 2019 Conference edition of Sage Magazine, an Fi360 publication.

My dad taught me about the meaning of fiduciary when I was about five years old. Putting it in the context of love, he said when you care about someone, when you love them, you want to put their happiness before your own. This is very similar to the duty of loyalty a fiduciary has to their client. Dad, a veteran of the Marine Corps and a Naval aviator, was a NY Life Insurance marketing executive when the primary product was life insurance, bought to protect your family. Later, I worked my way through New York University as a Series 7-registered broker. I was not very good at selling stocks, as it really bothered me if someone bought a stock that lost value. This was just before the dawn of financial planning and brokers mostly bought and sold stocks for their customers. I soon left to learn the bond business, later underwriting and trading munis and govies in the days of double-digit interest rates. Bonds, I could understand.

Later, as an investment advisor and fiduciary, I finally “got” the investment business in a way that made sense to me: fiduciary duty, diversification, risk management and portfolios. The conversations on the advisory side brought me back to my dad’s analogy and what was important to me.

Over the years I’ve had opportunities to work directly with clients, as well as create informational services for investors that helped them utilize investment data in new ways. As a senior editor for Investment Advisor (IA) magazine and editor-in-chief of Wealth Manager magazine and website, I got to advise the advisors. I told my boss in early 2009 that the word of the year was going to be fiduciary.

In the midst of The Great Recession, individual investors saw their portfolios declining, unemployment soaring and neighbors’ homes foreclosed. Retirement accounts declined to the point that many soon-to-be-retirees decided to work for several years longer – if they were lucky enough to have a job. The middle class, which largely had nothing to do with the causes of the crisis, were nonetheless harmed by it. The Wall Street Journal carried page after page of banks’ fire sales of credit default swaps, collateralized mortgage obligations, derivatives the banks were desperate to get off their books. Mary Schapiro was taking the helm of the Securities and Exchange Commission at this monumental time, early in 2009. There was discussion about what kinds of reform would be necessary to prevent this kind of a catastrophe from happening ever again. Schapiro would be a key regulator, with the FDIC’s Shelia Bair, and the new Consumer Financial Protection Bureau’s Elizabeth Warren. I’d interviewed Schapiro when she was at NASD-Finra about why there were two regulatory regimes, and brokers and investment advisors were using the same titles but were behaving in totally opposite ways. Would 2009 finally be the time to fix this?

SEC Chair Shapiro and I spoke again for a cover story in Investment Advisor, and she acknowledged that having two different regimes for investment intermediaries was still an ongoing problem. The SEC’s 2008 Rand study indicated that individual investors did not understand the differences in investment intermediaries and that most investors thought whoever they worked with on their investments was working in the investor’s best interest. This was the first of several calls and meetings with Chair Schapiro about the fiduciary standard, a discussion that continued during her tenure at the SEC as the commission studied how to better protect investors, which is now part of their mandate.

I went to the Fi360 Conference for the first time in 2009, to report on it and hear from fiduciary experts. As it turned out, they felt about the investment world much the way I did. I went to report; I found a home. At a dinner at that first conference, another columnist, an RIA compliance officer, Knut Rostad, and I talked about whether we could help regulators understand what fiduciaries do and how a fiduciary approach could help investors make their way with less risk and better long-term outcomes. The Committee for the Fiduciary Standard was born from that conversation.

A handful of investment advisor luminaries including Harold Evensky, Roger Gibson, Blaine Aikin, Sheryl Garrett and Clark Blackman, joined us to become founding members of the Committee. It’s through our work together that I learned about the Accredited Investment Fiduciary® (AIF®) Designation. I was so impressed with the structure and content of the program, and the AIF® Designees I met, that I decided to earn my designation. Later, I chose to leave journalism as the future of the industry grew uncertain.

Roger Levy, a great friend and fiduciary colleague of mine, introduced me to the Centre for Fiduciary Excellence (CEFEX®) and described what he was doing as a CEFEX® Analyst, conducting peer-reviewed assessments for RIA firms to the Global Fiduciary Standard of Excellence. Once an organization achieves CEFEX certification, they earn the privilege to use the CEFEX mark. He nudged me to look into the organization. I did, was properly impressed and decided to become an Accredited Investment Fiduciary Analyst® (AIFA®) Designee and CEFEX Analyst. It’s gratifying to work with RIA firms, foundations and retirement plan sponsors and offer them peace of mind as we navigate the certification assessment process together.

Now my consulting firm, FiduciaryPath, LLC, is also conducting Fiduciary Essentials® workshops for investment stewards – foundation and endowment boards and plan sponsors. The fiduciary framework that this short course provides to nonprofit boards and plan sponsor fiduciaries really is essential. They often don’t know that they are fiduciaries, and that they are personally liable if assets are not prudently managed – so this knowledge isn’t just essential, it’s critical. We enjoy bringing people into the fiduciary embrace with these courses and relish our role in spreading the good word about all things fiduciary.

ICYMI - June 14, 2019

Posted by Fi360 on June 14, 2019

Reg BI Cometh! *

Who isn't talking about the SEC's decision on Regulation Best Interest on June 5? Our subject matter experts have a lot to say about the latest developments. Join Blaine Aikin, AIFA®, CFA, CFP®, and Duane Thompson, AIFA® on Tuesday, June 18 at 2:00 p.m. ET as they parse the details of the newly adopted regulations, including what’s new, what was expected, and what surprised them. Register now for the webinar.

What Crayola Color of 3(16) Does Your Vendor Provide?*

Later this month, we are hosting an educational webinar to untangle the nuances of what consistutes a 3(16) administrator and what falls into 3(16) services. Join us on Wednesday, June 26 at 2:00 p.m. ET to learn about how understanding 3(16) services can be an opportunity for advisors to be the resource that helps plan sponsors determine what menu of services are needed to achieve their goals and assist them with finding service providers who best address those needs. Register now for the webinar.

Fi360 Stable Value Vision - A look inside!

Our team has received a great number of inquiries about stable value funds - what they are and how best to evaluate them. Tyler Kirkland, AIF®, PPC®, recently hosted a webinar about stable value funds and offered a peek inside the Fi360 Stable Value Vision software. We've got lots of resources for you here, so be sure to check out Tyler's webinar, his in-depth due diligence guide and our stable value white paper.

RIAs Find Differentiating Themselves An Uphill Battle Post SEC's Reg BI

Earlier this week, Financial Advisor magazine's Tracey Longo published an in-depth report about the impact of the SEC's Regulation Best Interest on advisors. The prognosis: things are fuzzy. Duane Thompson, Fi360's senior policy analyst said, “Advisors may be able to say that they are fiduciaries and that brokers are not, but the Form CRS disclosure mandates the use of boilerplate language stating ‘we have to act in your best interest and not put our interest ahead of yours.’ So how do you explain to an investor the difference in a best-interest standard of a broker compared to the best-interest standard of an advisor? It’s not going to be easy and will require thoughtful reasoning and practice, shall we say, before the mirror." Check out the full article.

SEC 'guts' RIA industry with a footnote, degrading fiduciary duty

Ann Marsh of Financial Planning boils down the SEC's sweeping impact on wealth management to a single word. "By substituting an 'and' for an 'or' in a footnote last week, the SEC watered down the meaning of investment advisors’ fiduciary duty to clients." Lots of strong reactions to this news in the full article.

*This webinar has been accepted for one hour of CE by Fi360, CFP Board and IWI.

Rebecca Hourihan + Fi360

Posted by on June 07, 2019

2019 marks Fi360's 20th year of promoting fiduciary excellence. We asked some of the folks in our community to share why they work with Fi360. Because let's face, they say it way better than we can!

Check out our first video from long-time friend of Fi360, Rebecca Hourihan, founder of 401(k) Marketing!

Stable Value Funds Due Diligence Guide

Posted by Tyler Kirkland, AIF®, PPC®, Director of Business Development and Client Engagement on March 01, 2019

Recently I hosted a webinar on Fi360's Stable Value Vision – a software solution which allows for the side-by-side evaluation of stable value funds. The output of the product provides a detailed comparative analysis of most stable value offerings.

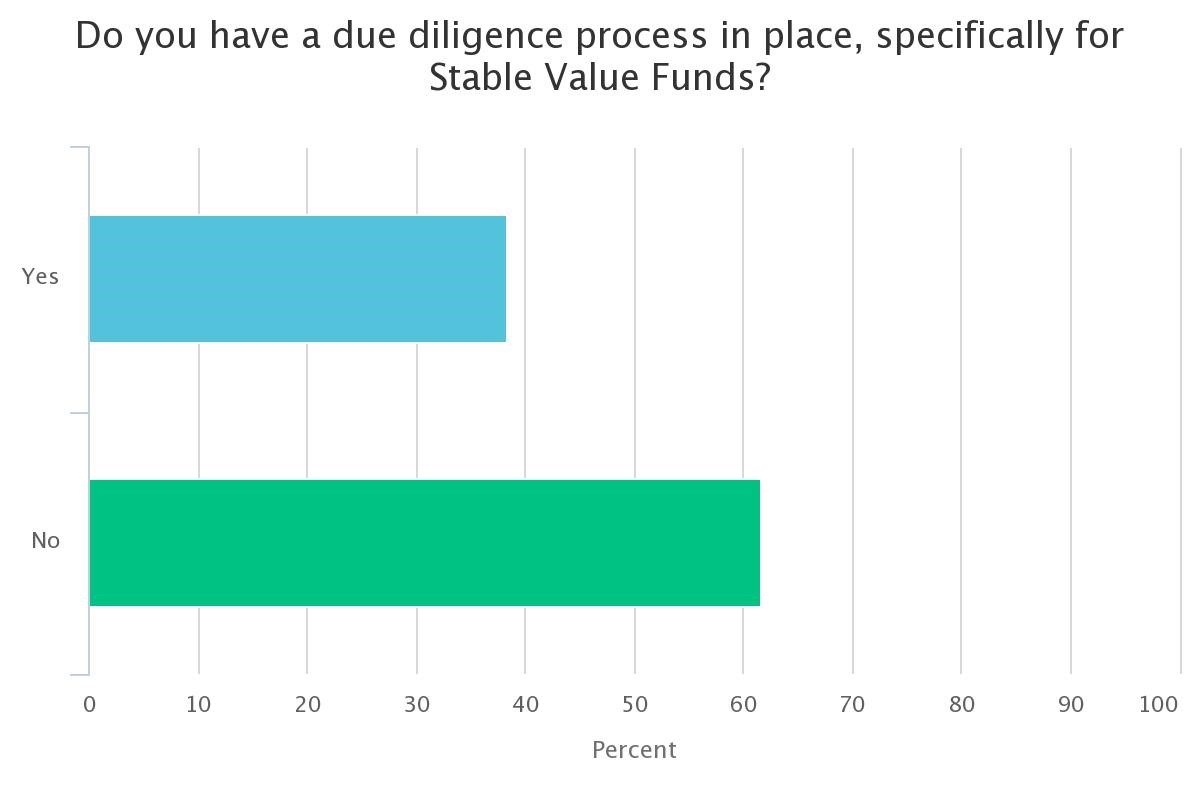

During the webinar, the following poll was conducted. It was discovered that the majority of those who participated in the poll did not have a well-defined due diligence process for stable value funds.

Is this a big deal? In typical Tyler fashion, allow me to sarcastically answer your question with a question….

Is it okay to tell a client that you have a have a process put in place to conduct due diligence on MOST of the investments in their fund line-up, but not all?

Without a well-documented process for fund selection and monitoring, for all fund types, you are at risk!

Stable Value Fund Basics

To review, stable value funds are designed to help you preserve capital while generating returns that are consistent with what you can get from fixed-income investments. In other words, be an investment product that doesn't lose value and provides a solid return.

Stable value funds have diversified portfolios of fixed-income securities that closely resemble what you'd find in a typical bond fund but take an additional step to protect their investors from interest rate fluctuations. Specifically, stable value funds enter into contracts with banks or insurance companies that are specifically designed to offer rate protection.

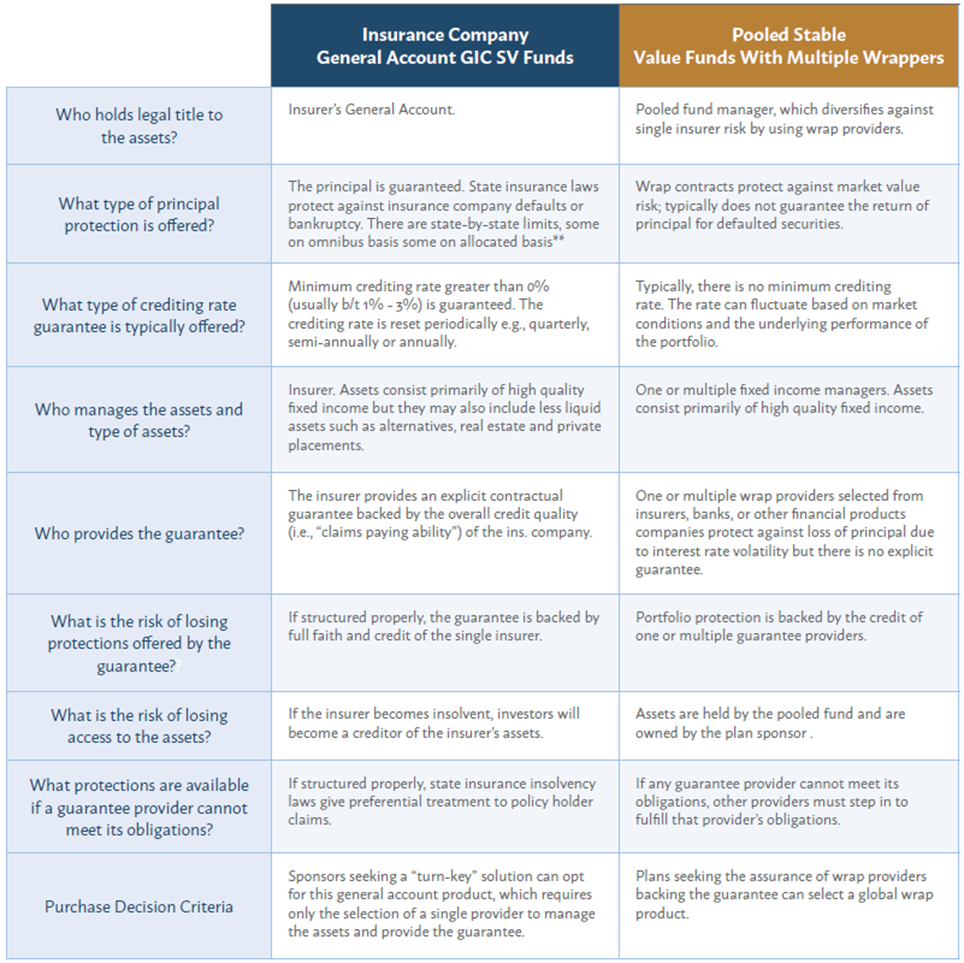

There are two (2) main types of stable value funds. See the image below for details.

The Six Keys

We take into consideration 6 key areas in evaluating and comparing stable value products:

- Transparency - What am I buying?

- Flexibility - What are my options?

- Fund Structure - How does it work?

- Management - Are the managers qualified?

- Value - What does it cost?

- Performance - What is my return?

As you read on, you will discover 21 datapoints that can be used in your stable value fund due diligence process. I say can because depending on the type of stable value fund you are evaluating; some criteria won’t apply. All the data points below are featured in Fi360's Stable Value Vision software.

Transparency

When evaluating the transparency of a stable value fund, the following points should be considered:

- Does the fund disclose its crediting rate formula or spread earned on assets? Put another way, does the investment manager provide specific information on how the return to investors is calculated?

- Crediting rate determines interest rate applied to the book value of a stable value investment contract.

- The spread is where the investments generate more in profit than the cost of deposits and is a source of income for some product manufacturers.

- Who/what is the determiner of the crediting rate?

- The manager?

- A function of the capital markets?

- A function of a portfolio of investments?

- Does there exist a crediting rate floor for this fund?

- Insurance Company General Account GIC Stable Value Funds have a minimum crediting rate greater than 0 percent, usually between 1 percent and 3 percent. The crediting rate is reset periodically e.g., quarterly, semi-annually or annually.

- Pooled Stable Value Funds with Multiple Wrappers typically, do not have a minimum crediting rate. The rate can fluctuate based on market conditions and the underlying performance of the portfolio.

Flexibility

Flexibility, as it pertains to stable value funds, should take into consideration the included points. As this section can get a bit complicated, allow me to expand on these concepts.

- What is the maximum acceptable put provision that you will accept in a stable value fund?

- A put provision is the amount of time required to pass before a plan can exit (resell) a stable value fund at book value.

- When investing in a GIC, a plan may be more restricted than the sponsor realizes, specifically with regards to the “Put Provision”, and most funds offer two options:

- The first is an immediate payout based on a lesser of book or market value. Depending on the market-to-book ratio and interest rates, the stable value fund could pay out less to participants than current book value.

- The second discontinuance option is usually a 1-year or 5-year “put” option. This option means that the plan will receive its assets over a 1- or 5-year period, which is a long time to worry about participants transacting out of the fund. Additionally, during this 5-year period, some contracts become “non-benefit responsive”, meaning that they will not allow participants to redeem during this period.

- Review of the “Put” provision and how it works – This is critical as most plan sponsors don’t understand this.

- Does the fund contain a competing fund provision?

- You are essentially evaluating if it is okay for the fund to restrict certain investment types from being represented in the plan's investment menu.

- There was a time in the stable value industry when the term “competing fund” almost always referred to one thing: a money market fund. No longer!

- Does the fund contain an equity wash provision?

- Here, you are establishing whether or not it is okay for the stable value fund to require transfers from the stable value product to a competing option to be “washed” or directed to another investment option not designated as a competing option for a period of time.

- Equity washes usually last 90-days

Fund Structure

This section’s criteria are dependent on the type of stable value product you are evaluating. I have expanded on the topics I thought needed some further elaboration.

Things to consider:

- The number of wrap providers

- These providers are offering wrap contracts

- Stable value investment contract that “wraps” a designated portfolio of associated assets within a stable value investment option to provide an assurance of:

- Principal and accumulated interest for that portfolio

- Payment of an interest rate

- Stable value investment contract that “wraps” a designated portfolio of associated assets within a stable value investment option to provide an assurance of:

- Wrap contracts can be issued by banks, insurance companies, or other financial institutions.

- These providers are offering wrap contracts

- The average wrap provider credit rating

- Each wrap provider has a credit rating. This is an evaluation of the credit risk predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting.

- Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

- The number of investment managers

- The credit quality of the underlying fixed income portfolio

- The portfolio duration

- Your desired portfolio sector concentration

- Your desired allocation to cash of the portfolio

Management

The things to consider from a managerial perspective for Stable Value funds are pretty standard, relative to other investment product types:

- Manager Tenure

- Minimum Fund Size (AUM)

Value

When questioning the cost of a stable value fund, keep an eye on both of the following points:

- Expense Ratio - A fund’s operating expenses expressed as a percentage of average net assets.

- All-In Expense Ratio - The total cost of the overall product, also known as the gross expense ratio, that includes all investment management fees, insurance company wrap fees, administrative fees, revenue sharing, and any other applicable fees that an investor would pay for the product.

Stable value fees can be confusing. For certain types of products, like the pooled, fees are expressed as an expense ratio making it easy to compare products. For other types of products like traditional insurance company general account products, the underlying costs are not reported as an expense ratio.

If you don’t see an explicit cost, then you can assume that the fees – whatever they happen to be – are being netted out of the gross return. You will want to ask for a detailed breakout of fees in order to help your client to make an informed buying decision and document this request.

Performance

When it comes to the performance of stable value funds, paying attention to standard performance metrics is important. We include:

- 1-Year Performance

- 3 -Year Performance

For those seeking long-term capital appreciation, stable value funds won't provide the level of growth most people need to achieve their retirement goals. However, as a component of a balanced portfolio that includes more growth-oriented investments, stable value funds can reduce overall portfolio risk while avoiding some of the key pitfalls of many fixed-income investment options.

Although unlikely, it is possible to lose money by investing in a stable value fund. Knowing how to identify a “good” stable value product can also minimize the chance for loss.

You should also consider the following, in addition to returns:

- Does this fund have an acceptable market-to-book ratio?

- The market-to-book ratio seeks to evaluate whether the product is over or undervalued by comparing its book value and its market value.

- The market value, at any point in time, is determined by the financial marketplace.

- The book value, in contrast, is the net asset value.

- A ratio higher than 100 is preferable as a ratio lower than 100 indicates that the value of the investments has fallen below the dollar amount contributed by participants, or the book value. Participants who are withdrawing cash from the fund are now relying on the insurer to cover the difference between market value and the book value of the total contributions.

- The market-to-book ratio seeks to evaluate whether the product is over or undervalued by comparing its book value and its market value.

- Does the fund have an acceptable crediting rate?

- Mentioned previously, the crediting rate determines interest rate applied to the book value of a stable value investment contract, typically expressed as an effective annual yield.

- As provided in the investment contract, the crediting rate may remain fixed for the term of the contract or may be “reset” at predetermined intervals.

Resources!

To continue your education on stable value funds, here are some additional resources that you may find useful:

The Takeaway

“Is one of the stable value product designs fundamentally better than the other”? The short answer is ‘NO’!

The takeaway here is that if you follow a due diligence process you can recommend either product type.

If you'd like set up a demo of Fi360 Stable Value Vision, contact sales@fi360.com, call 866-390-5080 or join us on Tuesday, March 5 for a webinar. You are now one step closer to being a Super Fiduciary!

Fi360 – the Early Years

Posted by J. Richard Lynch, AIFA®, Director on February 15, 2019

Fi360 was founded in 1999 in a suburb near the University of Pittsburgh. There were several core objectives that guided us from the outset, including:

- Develop a checklist that defined a fiduciary standard of care that would apply to any financial service professional providing investment advice

- Teach courses that explained this fiduciary standard of care and how to assess one’s adherence to it

- Provide online tools that would help advisors implement the checklist and therefore, better serve investors

In the Coast Guard, you would never launch an aircraft or get a ship underway without completing a checklist. This guarded against complacency and prevented seemingly unimportant, but critical, preparations from falling through the crack and not getting done. For either of these events, something forgotten could potentially lead to someone getting hurt. In 1999, the financial services industry did not have and most certainly needed a fiduciary checklist. Back then, I personally knew a couple clients who definitely got hurt in this industry.

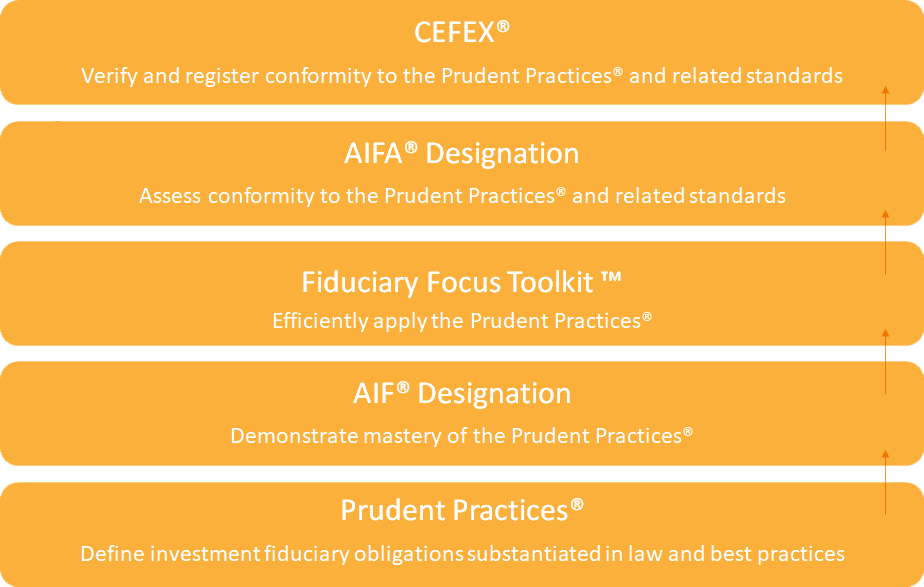

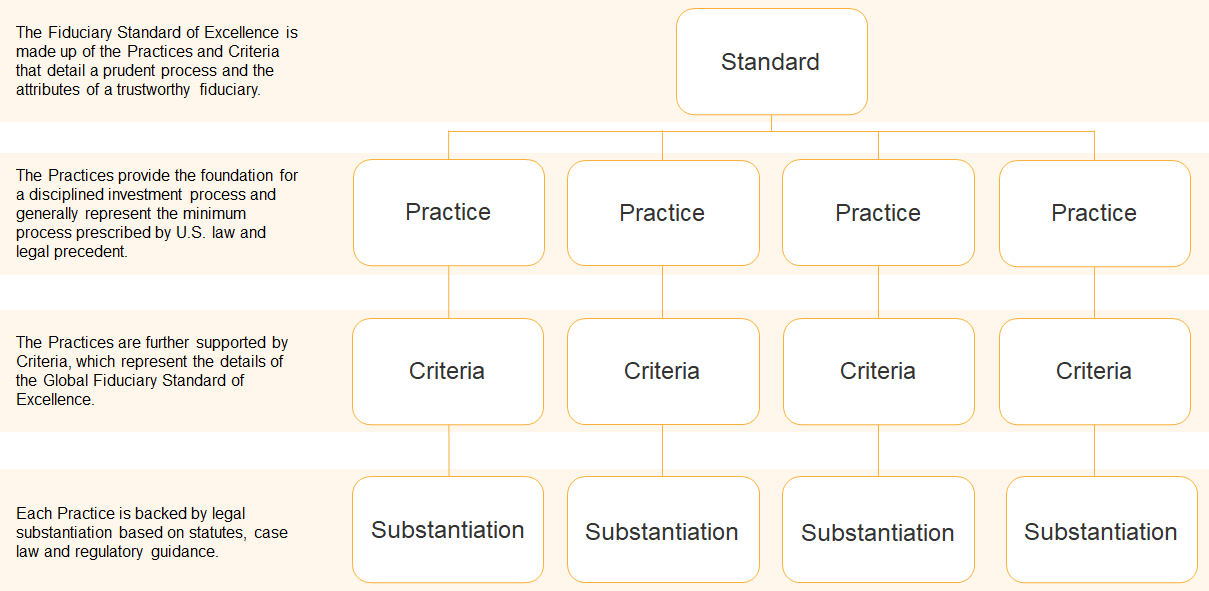

As the business plan for present-day Fi360, Inc. started to take shape, I was enlisted to help get the company off the ground. An exhaustive search through the applicable laws, regulations, case law and regulatory opinion letters led to an initial set of 27 Prudent Investment Practices. The Practices formed the basis of a curriculum for classes that we offered through our newly established Center for Fiduciary Studies at the University of Pittsburgh Katz Graduate School of Business. The classes evolved and eventually became the training component of the Accredited Investment Fiduciary® and Accredited Investment Fiduciary Analyst® (AIF® and AIFA®) Designations. The designations were first awarded in 2002. Along with feedback regarding the Practices from the students, we solicited comments through a public website for two years; we received over 8,500 comments during that time and made changes accordingly. With our final draft of Prudent Practices in hand, we visited the DOL and SEC to get their (unofficial) blessing before publishing our first Fiduciary Handbook in 2003. In the years that followed, our online tools, now known as the Fiduciary Focus Toolkit™, evolved and continued to improve alongside the Practices and related courses that we offered.

In order to establish creditability, we knew from the beginning that we would need to remain objective. This meant avoiding conflicts of interest if possible and properly managing them when they did occur. With that in mind, we made an early business decision to avoid providing investment advice directly to clients and focused solely on supporting professionals that did so. We never provided any investment products nor managed a single dollar. Over time, this approach came to be respected within the industry and was one of the keys to our success. It made sense from a practical prospective as well, as it would have been awkward, and we believe improper, to compete against those professionals we were committed to helping by developing the fiduciary Practices and providing related education and access to online tools.

Our startup years were difficult from a business perspective (there were some pay periods when we did not have adequate cash to meet payroll), but productive in that we were seeing growth and building a foundation for success. The vision we shared from the beginning was woven into the fabric of the organization. At Fi360 it always has and always will start with fiduciary.

Feb. 28, 2019 is National Fiduciary Day! Join us at one of our capstone events to earn your AIF®Designation. Already a designee? Celebrate with us! Share a story of your own fiduciary excellence on social media. Tag @fi360 or use #NationalFiduciaryDay and we will repost to our account.

Fiduciary Excellence Part 4: Monitoring the Client Engagement

Posted by Terra McBride, MBA, AIF®, Vice President of Marketing & Professional Development on February 01, 2019

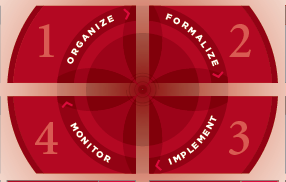

We’ve arrived at the fourth and final step of the Fiduciary Quality Management System - Monitor. Just getting here? Be sure to check out our posts on the first three steps, Organize, Formalize and Implement.

The duty to monitor is a fiduciary duty substantiated by… well, just about everything! ERISA, Advisers Act of 1940, UPIA, UPMIFA and UMPERSA all address this responsibility. So, pay attention because this is an important one.

We find that most advisors struggle with this step. For starters, the duty to monitor is the most time consuming and expensive because technically it never ends. In addition, this is where a fiduciary breach is most likely to occur. There are a couple of reasons for this.

First, at this stage, your new client transitions to an older client. As we look at our long list of to-dos each day, it feels like the right move to bump activities associated with newer clients up on the priority list and to let the tasks associated with older clients move down the list.

Second, it’s human nature to become complacent. For these reasons, it’s so important to implement a prudent process that will help keep you on track with ALL clients.

The three major pieces of this step are:

- Quantitative and qualitative reviews

- Fees and Expenses

- Fiduciary Reviews (what can I do better?) -> Evaluate objectively how to make continuous improvement

We’re going to keep this post at a higher level but if you’d like to get into some details, check out Rich Lynch’s fantastic webinar focused on Step 4 of the Fiduciary Quality Management System.

Quantitative and Qualitative Reviews

Performance reports are a huge part of the quantitative side of reviews. You’re examining the performance of investment managers and comparing that performance to an appropriate index, their peers and, most critically, to the objectives of the Investment Policy Statement (IPS).

The IPS should clearly articulate who is responsible for putting together the performance report, which should be delivered quarterly at a minimum and during a face-to-face meeting at least once a year. In the instance of litigation, the court will look for quarterly documentation of a performance review.

Depending on the client, you may need to report on performance more frequently. While the process for working with clients should be consistent, the following factors should be considered when determining the frequency of performance reporting for each client.

- Specified fiduciary requirements

- The size of the investment program

- The investment strategies employed

- The sophistication of the investment program

- The volatility of the investments selected

- The general economic and market conditions then prevailing

This is largely a number-crunching exercise. But the advisor truly demonstrates value, not in the numbers in the report, but in the analysis of those numbers.

A qualitative review is more of an art than the quantitative review. You’re watching for signals or red flags that will trigger you to ask additional questions. Periodically review information such as:

- Staff turnover

- Organizational structure

- Level of service provided

- Quality of reports

- Quality of responses to requests for information

- Investment education

- News headlines that may indicate something isn’t right with an organization

Control and Account for Investment Expenses

Controlling for expenses is the meat of the Monitor step, and also the piece that many advisors find challenging. We get it! This is an area of intense scrutiny by regulators and through lawsuits so we know you want to get it right.

Plans must evaluate and account for investment-related fees, compensation and other plan expenses, which are disclosed in 408(b)(2) disclosures. It’s our position that other institutional accounts like endowments and foundations should also provide 408(b)(2)-type disclosures. Given the scrutiny in this area, why wouldn’t you?

The IPS must include a description of how the fiduciary will control for fees and expenses. In other words, figure out who is being paid and for what services. It’s important to note that fees and expenses go well beyond the investment managers. I point this out because we’ve had several advisors assume they’ve done their duty by simply disclosing the expenses associated with the money managers. But there are really four categories that should be addressed:

- Investment or Money Manager: Fees and/or annual fund expenses

- Execution – Brokerage: Trading or processing costs (i.e. commissions, soft dollars, directed brokerage and 12b-1 fees)

- Consultant or Advisor: Consulting and admin costs

- Custody – Recordkeeping: Custodial fees and transaction charges

While it may not seem tightly associated on the surface, controlling for fees (Step 4-Monitor) and uncovering conflicts of interest (Step 1-Organizez) are directly related. We tell our advisors, “If you ever wonder whether there is a conflict of interest that is problematic, follow the money.” When you understand who is getting paid and for what services, you have a clear picture of the plan and whether there are issues that need to be addressed.

What Is Fair and Reasonable?

“Fair and reasonable” is generally examined according to a “relative to what” standard. In other words, the fees and expenses are evaluated relative to the charges that would be incurred if the same services were supplied by a leading competitor. This is why a formal RFP process is suggested to select service providers and, as much as possible, to make apples-to-apples comparisons. Fi360’s RFP Director is a tool many advisors use to simplify, standardize and document this process.

There are two factors to consider when evaluating whether fees and expenses are reasonable.

- Can the fees be paid from the portfolio or plan assets? This must be considered from both a legal perspective and whether the organization itself will allow it.

- Are the fees reasonable considering the services provided? Data sources, like Fi360’s Fee Benchmarker®, can assist with this analysis.

We recommend making it a practice to evaluate fees and services every three years with the client. Get everything out on the table, what’s working and what isn’t, on both sides of the relationship. A lot can change over three years. The client will appreciate your willingness to regularly refine the relationship. You can strengthen an ongoing relationship and maybe even uncover an area where you can improve, which will help you remain competitive.

Fiduciary Review

The fiduciary review is where you objectively evaluate where improvements can be made. There’s a lot to consider. So here is a recommended schedule for you to use as a guide.

- Monthly – Review custodial statements

- Quarterly – Review overall portfolio and individual investment performance

- Annually – Review IPS, service providers and your own fiduciary performance. It’s extremely important you make sure the process and the IPS align exactly. If they no longer do, it’s time to make updates.

- Every three years – Revisit vendor contracts

- Impromptu –Reviews as circumstances dictate

The Process of Monitoring

The plan steward is looking to you for guidance on adhering to their fiduciary duties of loyalty and care. You will instill confidence and gain their trust by demonstrating that you have a thoughtful, prudent process. Apply an evidence-based approach by gathering and analyzing the facts surrounding the plan. Then provide points of action based on what you uncover. Act on your findings by taking any necessary corrective actions and then document everything. If you deviate from any precedents you have established for decision making, document, document, document!

Everything Fi360 delivers to the industry is rooted in our Prudent Practices. This step-by-step process ensures an investment strategy is being properly developed, implemented and monitored according to both legal and ethical obligations, taking the guess work out of how to work with your clients.

I hope you’ve enjoyed this series! As always, we are here to help make the fiduciary care you provide for your clients simpler.

Feb. 28, 2019 is National Fiduciary Day! Join us at one of our capstone events to earn your AIF® Designation. Already a designee? Celebrate with us! Share a story of your own fiduciary excellence on social media. Tag @fi360 or use #NationalFiduciaryDay and we will repost to our account.

Fiduciary Excellence Part 3: Implementing the Investment Strategy

Posted by Terra McBride, MBA, AIF®, Vice President of Marketing & Professional Development on January 23, 2019

We’re more than halfway through the Fiduciary Quality Management System. In my previous posts, we focused on the first two steps to implementing a solid prudent process – Organize and Formalize. The next step is to Implement the investment strategy.

There are three main components to the Implementation stage of a prudent process:

- Service provider due diligence

- ERISA safe harbors

- Investment selection

If there are any key takeaways from this step it’s that due diligence and documentation at every stage are absolutely critical to avoid confusion, or worse, down the road. We have a great webinar on how to implement a prudent investment strategy, hosted by our very own Rich Lynch, that is well worth the listen. Rich goes into great detail on each of the three components of this step.

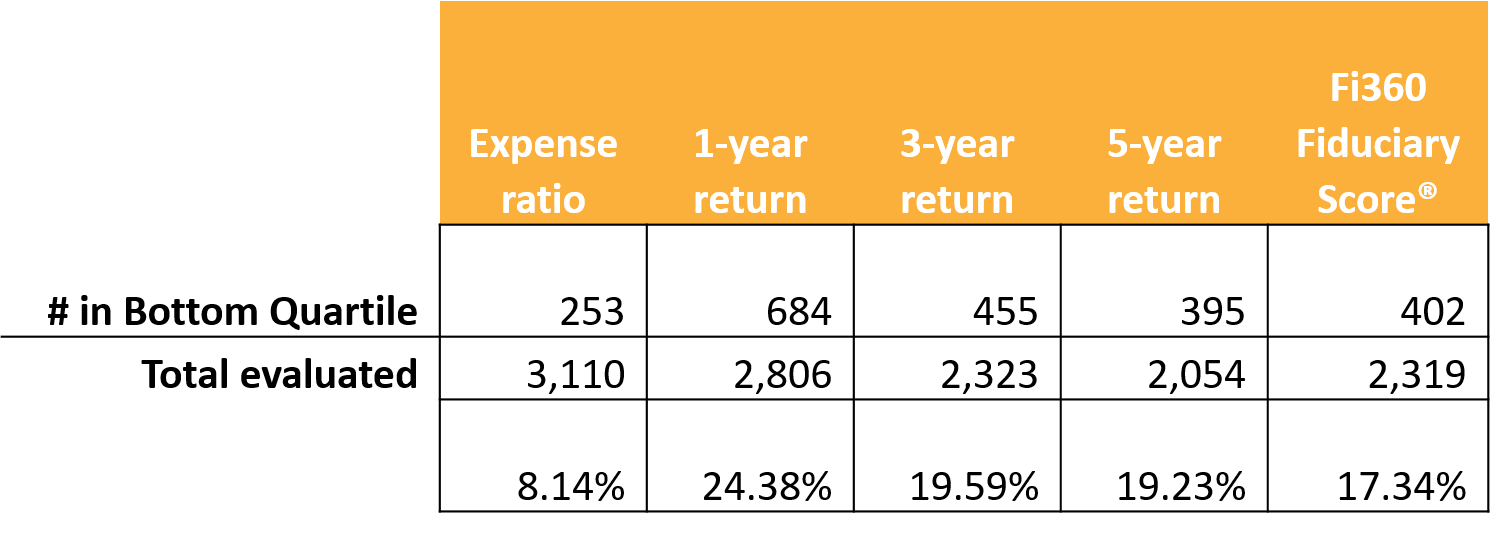

For the purposes of this post however, I want to highlight just one very important process for implementation – the suggested minimum criteria for choosing investment managers. I personally was impressed that despite what seems to be an ever-shifting regulatory environment, the criteria presented by Fi360 in selecting investment managers has remained largely untouched since the company’s founding in 1999. For something like this to withstand 20 years of political changes, regulatory proposals, market shifts and a Great Recession, it must be solid. So here it is!

Fi360’s Recommended Due Diligence Screens for Choosing Investment Managers

- Regulatory Oversight

Threshold: Managed by a bank, insurance company, registered investment company or RIA - Minimum Track Record

Threshold: At least three years history - Stability of the Organization

Threshold: Manager tenure of at least two years - Assets in the Product

Threshold: At least $75 million - Holdings Consistent with Style

Threshold: At least 80% - Correlation to Style or Peer Group

Threshold: Consistent with asset class being implemented - Expense Ratio | Fees

Threshold: Above 75TH percentile of peer group - Performance Relative to Assumed Risk

Threshold: Compare Alpha and Sharp Ratio to peer group median - Performance Relative to Peer Group

Threshold: Compare year performance to peer group median

Plan sponsors and stewards should engage professional investment managers, with assistance from the advisor to the plan. But this clearly is not a “set it and forget it” procedure. The managers must be evaluated and monitored, with a particular eye toward performance and expenses compared to appropriate benchmarks.

Feb. 28, 2019 is National Fiduciary Day! In celebration of the occasion, we are featuring each our Prudent Practices® right here. Stay tuned to the blog throughout this month for subsequent posts that highlight the other steps of the Fiduciary Quality Management System.

Fiduciary Excellence Part 2: Formalizing the Investment Strategy

Posted by Terra McBride, MBA, AIF®, Vice President of Marketing & Professional Development on January 15, 2019

In my previous post, we reviewed what it means to act as a fiduciary and we discussed what we here at Fi360 believe is the first step to enacting a fiduciary process – Organize. Step two of the Fiduciary Quality Management System is to Formalize your process. Michael Muirhead, AIF®, PPC®, senior vice president, learning and development at Fi360, hosted a great webinar focused on the second step of the Fiduciary Quality Management System, during which he gets into some details we won’t touch on here, like how to approach diversification, defining the investment profile, calculating risk and asset selection. I encourage you to check out that webinar for a deeper dive.

Let’s dig into one of the most important pieces of building any plan – the Investment Policy Statement or IPS. As an employee at Fi360, I feel like we talk about the IPS non-stop. However, it is the foundational document that formalizes the overall strategy for investment fiduciaries. While ERISA never uses the term “Investment Policy Statement”, case law suggests not having an IPS could constitute a breach of fiduciary duty.

Benefits of an IPS

Creating an IPS is 100 percent worth the effort. Here are four reasons why.

- In the event of an audit, litigation or some type of dispute, the IPS provides a paper trail for how the portfolio is being managed.

- The IPS will help mitigate what we like to call “Monday morning quarterbacking”. In other words, the IPS documents how the portfolio was being managed and that the process was agreed upon by everyone involved. Should a new trustee or advisor take a look at the portfolio, the IPS will help eliminate any second guessing about how decisions are being made.

- During stressful market scenarios, the IPS is the sort of North Star for how to proceed through the turmoil, helping to insulate the decision makers from market noise.

- Fiduciary excellence can only be achieved through prudent processes, consistently applied. The IPS is the governing document that allows for consistency in that prudent application.

The Essential Elements of an IPS

There are tons of resources out there that can help you construct an effective IPS. We have a few of our own. Whatever method you choose to develop your own document, make sure it includes the following components.

- Plan purpose including governing law

- Duties and responsibilities

- Risk, return and time horizon parameters

- Diversification and rebalancing guidelines

- Due diligence criteria for selecting investment options and service providers

- Procedures for controlling and accounting for investment expenses and service providers

- Monitoring criteria for investment options and service providers

- Signatures

It may seem silly to include signatures on the list of essential elements, but you would be shocked to see how many IPSs are created but not signed by all relevant parties. Without signatures, the legal standing of your IPS could be challenged.

Using the IPS to Limit Liability

The primary reason a plan sponsor will outsource functions related to the plan is to mitigate their fiduciary liability. The IPS clearly helps with that purpose, but an IPS isn’t effective unless it’s formally adopted.

We strongly suggest having the document reviewed by an attorney who has some familiarity with the laws and regulations associated with the applicable portfolio. Again, have the IPS signed by all parties named in the document. Next, be sure to implement the policy by following the written guidelines when selecting and monitoring plan investments and service providers. Remember, the IPS is the advisor’s roadmap for making investment selections. Use it! And finally, document that the IPS is being followed during annual reviews and update it if necessary.

Practical Takeaways

If you’re new to a plan and an IPS exists, review it. We have found that most IPS documents could be improved or updated. So, understanding the key components of IPS construction can open doors and provide opportunities.

The process of selecting and monitoring plan assets is one of the most critical functions a plan fiduciary can take on. Understanding the important aspects of the IPS is a vital fiduciary function for existing clients but it also creates a new business opportunity for advisors to demonstrate their worth as educators and experts for prospects.

Fun fact: References to fiduciary principles can be found dating back to 1790 B.C. In fact, the core facets of fiduciary principles can be found in ancient texts of each of the major religions. So, we’re obviously understating things when we say the concept of fiduciary duty isn’t a new one.

Feb. 28, 2019 is National Fiduciary Day! In celebration of the occasion, we are featuring each our Prudent Practices® right here. Stay tuned to the blog throughout this month for subsequent posts that highlight the other steps of the Fiduciary Quality Management System.

Fiduciary Excellence Part 1: Organizing a Client Portfolio

Posted by Terra McBride, MBA, AIF®, Vice President of Marketing & Professional Development on January 07, 2019

Managing the assets of another person or of an organization puts you in a special relationship of trust, confidence and legal responsibility. In other words, you are a fiduciary. As such, you are bound by the dual duties of loyalty and care.

Even though the DOL fiduciary rule has been vacated, the Impartial Conduct Standards are in play. Your duty of loyalty as a fiduciary is encapsulated within the Impartial Conduct Standards. And therefore, you are required to act in the best interest of your clients, with no more than reasonable compensation and no misleading statements.

Understanding what it means to be a fiduciary is one thing. Conducting yourself as a fiduciary is something else entirely. Last October, I earned my Accredited Investment Fiduciary® (AIF®) Designation. During my studies, I was surprised to learn that the law does not speak of performance in instances of a fiduciary breach. It’s all about process. Sure, a client may sue an advisor because of performance. But if the advisor can clearly demonstrate that they followed a prudent process, it’s extremely difficult for the litigant to claim there was a fiduciary breach based solely on performance.

I imagine your goal is to strive for fiduciary excellence with all of your clients. But what does that really look like? Well, our philosophy (rooted in case law, by the way) is that fiduciary excellence can only be achieved through prudent processes, consistently applied. Nearly 20 years ago, Fi360 created the Fiduciary Quality Management System, which clearly breaks down the steps you must take to apply a prudent process consistently. This system has a four-part structure – Organize, Formalize, Implement and Monitor.

Let’s take a look at the Organize step at a high level.*

FQMS Step 1: Organize

The first step of the Fiduciary Quality Management System is to Organize. This step entails knowing and following the rules, understanding and acknowledging roles, avoiding or properly managing conflicts of interest and protecting client assets. I won’t dig into each of these items for this blog post. But if you’re interested in learning more about the Organize step in detail, check out Rich Lynch’s Coaching Call for Fi360 Designees dedicated to this topic.

Governing Documents

One of the criteria in our Prudent Practices® Handbook is to create and maintain a fiduciary file. The list of files we suggest including in this file is pretty lengthy and is often ignored. Governing documents will help you define roles, set criteria, establish service requirements and demonstrate procedural prudence. Some of the key documents you need include:

- Summary Plan Document

- Summary of Material Modifications

- Investment Policy Statement (IPS)

- Trust Document

- Investment Committee Policies or By-laws

- Spending Policy

- Conflict of Interest Policy

Closely following this recommendation is not only crucial to keeping you organized from the outset, but it sets you up well for documenting your prudent investment process.

Understand and Acknowledge Roles and Responsibilities

This may seem obvious but it’s important to determine who is in a fiduciary role and who is not. Think of the fiduciary as the commanding officer on a ship. That person is in charge and is responsible for the whole process. So, making sure everyone understands who fills that role is critical.

Next is the investment committee. For this group to function properly, there should be clearly defined policies or by-laws. The investment committee will also define the process for managing the portfolio. We recommend including members of senior management as well as staff from the rank and file. The bottom line is that anyone who serves on the investment committee must be willing to be objective, work together and put the interests of plan participants first. Another point that may seem obvious but it’s good to have an odd number of members for the investment committee, in the event you need to take a vote. And we suggest setting up the structure so that some of the members rotate out after a select period of time. This allows for a fresh perspective on the work being done.

Avoiding | Managing Conflicts of Interest

Don’t over-complicate this. If there is anything that prohibits you from being completely objective or if you believe there is a conflict of interest, then there probably is and you must remedy it. We strongly recommend putting a conflict of interest policy in place ahead of time, even if there is no conflict currently. You must plan for the “What if?” scenario.

Here’s a simple exercise for you:

Mary, a board member for a local eleemosynary, has serve on the board for three and a half years and has become influential because of her work ethic, investment expertise and ability to resolve conflicts when they arise. There is concern among several board members about their third-party advisor (a friend of the committee chairman) who has been engaged for five years and they feel is getting paid too much for the services provided. Some committee members are pushing for replacing the current advisor with Mary, who is a full-time investment advisor.

Questions:

Can Mary serve as both an investment committee member and the investment advisor?

What process should be followed in replacing the investment advisor?

While it is in no way illegal for Mary to act as both the investment advisor and an investment committee member, it creates an immediate conflict of interest. We would recommend Mary choose one role or the other. Regardless of Mary’s decision, the committee should go through a proper vetting process when replacing the investment advisor, even if Mary opts to throw her hat in the ring for the role.

Protecting Client Assets

There are some simple safeguards you can put into place that will go a long way in protecting client assets. Investment stewards must assess their service provider agreements and determine whether the relationship is “reasonable.” The only way to do that is to decide whether the services being provided are reasonable for what is being paid. Under ERISA, service providers MUST deliver:

- A description of services

- Status as a fiduciary or registered investment advisor

- Receipt of direct and indirect compensation

A best practice is to include these disclosures in all service agreements. Be sure to regularly review all vendor contracts and do it at least every three years.

Qualified plan assets should be held within the purview of a viable judicial system, so that they can be seized if there is suspicion of mismanagement. All plan sponsors must have a fidelity bond to protect from theft of the assets. Custodians require insurance, internal controls and physical security measures. And finally, plan assets and data must be secured against cyber threats. This last point is so important, we decided to add it as a criterion to our fiduciary handbooks.

The foundation of a prudent process is laid in the first step of the Fiduciary Quality Management System. Being able to consistently apply your prudent process can only happen when you are organized from the outset.

*Feb. 28, 2019 is National Fiduciary Day! In celebration of the occasion, we are featuring highlights from each our Prudent Practices® right here. Stay tuned to the blog throughout this month for subsequent posts that highlight the other steps of the Fiduciary Quality Management System.

Webinar of Webinars

Posted by Tyler Kirkland, AIF®, PPC®, Director of Business Development and Client Engagement on October 26, 2018

Being an Fi360 Designee comes with its perks! One of which is exclusive access to content created to aid in operational efficiency, further professional development and adding value.

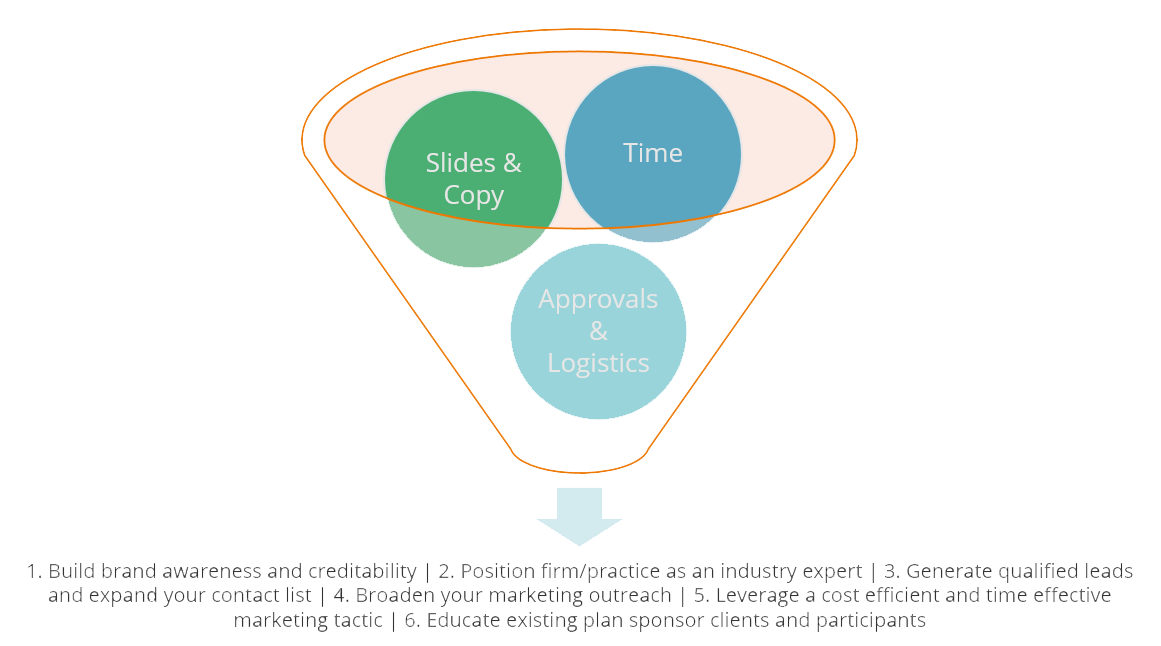

On a recent coaching call, presenter Michael Muirhead, covered how designees can Drive New Business with Webinars. ICYMI, check it out in our designee portal. The image below sums up the reasons webinars are beneficial as a device to increase sales. You see, with a few inputs, you can reap many outcomes with long-lasting impacts.

Tips for Conducting Successful Webinars

Choose topics focused on “Common Challenges” or “Change Events”

You want to present content that is relevant to the needs of your prospects. The goal here is to provide them with the answers they are looking for and in return you gain credibility and become a resource for future needs.

Leverage existing content from key partners (e.g. – DCIOs, Recordkeepers, Attorneys, CPAs, etc.)

There are no new ideas (so they say) so why reinvent the wheel? If you know of strong content from a partner, a simple (permitted) rebrand and prudent siting will go a long way. You still benefit from providing content with the ease of not developing it yourself! #Yes Please

Create compelling marketing copy

"Copy" is anything written by you or your company that is meant to attract customers to your business. According to Wendy Keller, CEO and Founder of Keller Media, Inc., there are three simple principles to writing good copy:

- Always think about the other person when you're writing.

- Burnish, to "burnish" means to rub something to a shine or gloss.

- Never, ever write anything without including a "CTA"(call-to-action), as marketers call it.

See the full article here.

Build your webinar landing page

This is your opportunity to collect what you need for an effective follow-up strategy. Remember you are going to deliver great content to those who need it. In exchange for high-value content, you should receive something. You may not charge a monetary figure in exchange for your webinar but you will receive something (such a contact information). In a way, that is more valuable than money. It is a chance, an opportunity to occupy time. Make sure you collect information necessary to execute an effective follow-up strategy. This is the key to turning a webinar into a profitable investment.

Develop your email promotion and follow-up strategy

Spread the word! You have developed or repurposed content. You have a landing page. Promote!!! Email and social media messages go a long way. The goal here is to expand your reach and invite audiences/niches who could benefit from the content but more importantly your services/solutions. Remember, you are giving content for the opportunity to follow up with them. Be sure your promotion strategy includes the following:

- Initial invites

- Follow-up invites

- Confirmation email following registration with an option to add the event to their calendar

- A 72- hour reminder message

- A “starting now” reminder message sent 15 minutes before your webinar goes live

- A “sorry we missed you” email sent to people who registered but did not attend the live event

- A “thanks for joining us” follow-up for live attendees to re-watch or share with colleagues

Conduct a practice webinar session and test

Practice makes perfect! The last thing you want on webinar day is to have a technology flop or to lose credibility due to lack of preparation. Go to the ball Cinderella, there is nobody stopping you but you! Do a dry run for your nerves and have a trusted friend or colleague give you feedback. You are not alone and a different perspective may help with your delivery. If no change comes out of your practice run, that's ok. At least you got another opportunity to flex those muscles before the live presentation.

Add opportunities for audience interaction

Being talked at and lectured to did not work in college and it doesn’t work outside of the classroom. Nobody wants to watch a dry presentation. Give it some gravy by breaking the fourth wall. The audience will have opinions and questions regarding the content you are presenting. Take polls! Take Questions! Do Surveys! Give Handouts! Make an impact and they will want to see what else you have to offer.

Use team members to help conduct webinar session

If you are a solo shop this is a bit more difficult but a team member can be a friend if a colleague is not available. The goal here is to ensure that all of the nuances of giving a webinar are taken care of such as slide progression, audio levels, polls and Q&A. There is a lot of choppy water during a webinar and a poor presentation can tarnish your attendees’ experience. Remedy it by having someone to help you paddle.

Be sure to record your webinar session

Recycle your content. If it was good once, it will be good again! Also, there will always be people out there who could not attend the live showing (but wish they could). Archive the content and make the presentation available for replay. Make your content work for you! If it is valuable, gate it. Make the interested party provide you with contact information in exchange for access.

What’s Next?

After you delivered your webinar, your follow-up will kick off your Active Sales Process.

Stick to your plan!

The juggling act of growing a book of business and delighting current clients is not easy to navigate. Effective sales, marketing and client service planning, and ruthless, focused execution is the key to a growing, fruitful practice.

Stay tuned for a future post highlighting an effective sales plan!

A Winning Proposition: The AIF® Partnering with an Independent Auto Rollover IRA Provider

Posted by Mark Koeppen and Jeff Linkowski, AIF® on October 15, 2018

Year-end planning for business owners takes on many forms, but for those that sponsor 401(k) plans, it should include a review of the company plan and preparing amendments accordingly. For AIF® Designees and advisors, that means a thorough review of the plan, including arrangements, agreements and service providers.

One persistent plan sponsor challenge (that results in wasted productivity) involves terminated participants, especially former employees and/or participants now missing or unresponsive. Low-balance terminated participants can be automatically removed via mandatory force-out (Fi360 Prudent Practices® Criteria 3.2.5).

The nature of these participants presents a range of issues for sponsors, as they are required to deliver formal plan disclosures and, in some cases, additional IRS and DOL reporting. Unresponsive former employees also drive up participant numbers while decreasing the average account balance, leading to less favorable recordkeeping plan pricing. Removing them in a timely manner is in the best interest of the plan sponsor. Advisors who specialize in the 401(k) market would be wise to use the year-end review as an opportunity to help plan sponsor clients address this challenge. As you strive to both maintain your current plans and identify additional business opportunities heading into 2019, removing or simulating the removal of de minimis participants can pave the way for new opportunities.

Forms 5500, Schedule C and Schedule H offer insight into how many company plan participants are former employees, how much the plan is paying in administrative fees and other fee arrangements. This gives you the opportunity to present strategies that improve the plan’s numbers. In addition, advisors can ask about IRS 8955-SSA, a not-for-public form filed by the plan sponsor when a participant separates from service covered by the plan in a plan year, and the participant is entitled to a deferred vested benefit under the plan.

Establish a plan

Advisors can partner with an independent IRA rollover provider to create a cleaner, more efficient plan for a record keeper to price. Plus maintaining that partnership with the IRA rollover provider is portable between recordkeepers and can provide stability that you can trust. This adds value to current clients and will establish your value with a potential client before securing that new plan.

The primary benefits of implementing automatic IRA rollovers include:

- Reducing administrative time and actual expenditures for plan sponsors

- Participant disclosures must still be made to ALL participants

- Mitigating fiduciary liability

- Leveraging these reductions to decrease plan pricing and the cost to existing participants,

- Enabling plan sponsors to focus on the participants who matter most and can drastically reduce red flags that lead to DOL audits

- Offering terminated employees a post-plan experience

- Reduce 401(k) leakage by providing the right IRA rollover experience the is low cost, generous default crediting rate and a user experience that is focused on financial wellness

Although the benefits are evident, many plan sponsors don’t take time to evaluate the services of an IRA rollover provider, which creates an opportunity for advisors to point out and help the client comply with their Duty of Prudence.

Auto rollovers/Mandatory Force-outs

As part of the mandatory 401(k) force-out process, when an employee leaves a company, accounts from $1,000 to $5,000 must be transferred into an individual retirement account. For accounts under $1,000, it’s generally assumed that participants will be forced out in cash, but unfortunately, this often results in uncashed checks. Adhering to that elementary thought process means missing a great opportunity to add value to your plan-sponsor client. As an alternative, recommend changing the force-out language in the plan document to indicate all accounts under $5,000 will be transferred to an IRA, with the help of an independent rollover provider.

This will alleviate a major pain point for plan sponsors, as again, accounts under $1,000 often result in uncashed checks. Whether the terminated employees can’t be located or simply aren’t being responsive, they and their assets are still officially part of the plan until those checks get cashed. The best way to attract and retain clients is by continuing to add value year-over-year.

Implementing strategies to address the missing participant issue, deal with uncashed checks and institute a totally free solution by forcing out all accounts under $5,000 into an IRA creates good will among current clients, strengthens your role as a trusted advisor and enhances the value that can be offered to potential clients.

Do the math

The two major factors that typically figure into a recordkeeper’s cost analysis/pricing for a 401(k) plan are: the number of participants and average account balance. Removing low-balance terminated participants results in fewer participants, while simultaneously increasing average balance among remaining participants. Decreasing the former and increasing the latter offers a great scenario to obtain a better price. It also helps adhere to several Fi360 Practices and Criteria regarding Monitoring. Both objectives can be achieved by rolling over all accounts under $5,000 into an IRA. Furthermore, uncashed checks can lead to fines from the DOL since sponsors have a fiduciary duty to act in the best interest of all plan participants. Such audits can result in fines that may cause the sponsor and recordkeeper to argue over who should pay, with you getting pulled into the middle. Implementing automatic IRA rollovers helps avert this type of contentious situation that can jeopardize client relationships.

Service Providers

AIF Designees subscribe to the Prudent Practices®. Such practices mandate due diligence in all aspects, including reviewing service providers and agreements. As a good rule of thumb, it is generally better to use an independent auto rollover provider separate from the bundled recordkeeper. Many large bundled recordkeepers like to move low-balance, terminated participants into their own IRA product and will not accept accounts under $1,000 or be proactive in locating missing participants. Recordkeepers could also enter into an exclusive arrangement with an IRA provider who is paying the record keeper for transferring accounts. In the latter, the recordkeeper may be acting in a fiduciary role by selecting a single provider and not offering the plan sponsor any alternative. Moreover, said revenue arrangements should be disclosed as they represent a possible conflict of interest.

From all of these perspectives, and as an AIF® Designee and advisor, you should help your clients comply with their fiduciary obligations and provide comparisons to aid in their due diligence. In your annual meetings, reviewing the auto rollover IRA solutions should be added to your standard benchmarks and ensure your clients are following their document by removing terminated participants regularly. The evidence supports that partnering with an independent IRA rollover provider is a winning proposition.

Some specific Fi360 Prudent Practices® criteria references regarding auto-rollovers are:

- 1.3.2 Acknowledge Status as a Fiduciary

- 1.4 Conflict of Interest – Service Provider

- 1.5.2 ERISA Disclosure

- 3.1 Due Diligence on Service Providers

- 3.2.5 Auto Rollovers

- 4.4 Fees

- 4.4.1 Who is being paid what?

Mark Koeppen is Senior Vice President of Strategic Rollovers at FPS Trust Company in Centennial, Co.

Jeff Linkowski, AIF®, is Director of Sales for FPS Trust

Don't forget to check out Fi360's webinar on mandatory force-outs on Tuesday, October 16 from 2:00 - 3:00 PM E.T.

A Math Nerd's Evaluation of Blaine's Reputation White Paper

Posted by Tyler Kirkland, AIF®, PPC®, Director of Business Development and Client Engagement on August 31, 2018

Warning #1: This post is a little different from my typical playful delivery.

I recently sat in on a webinar called "How much is your reputation worth?" It was presented by Scott Revare, AIF®, managing director with Fi360 and Blaine F. Aikin, AIFA®, CFA, CFP®, executive chairman with Fi360 and CEFEX.

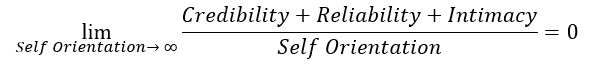

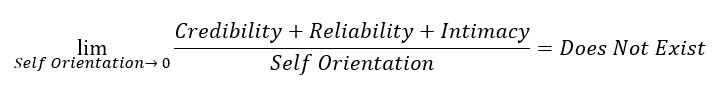

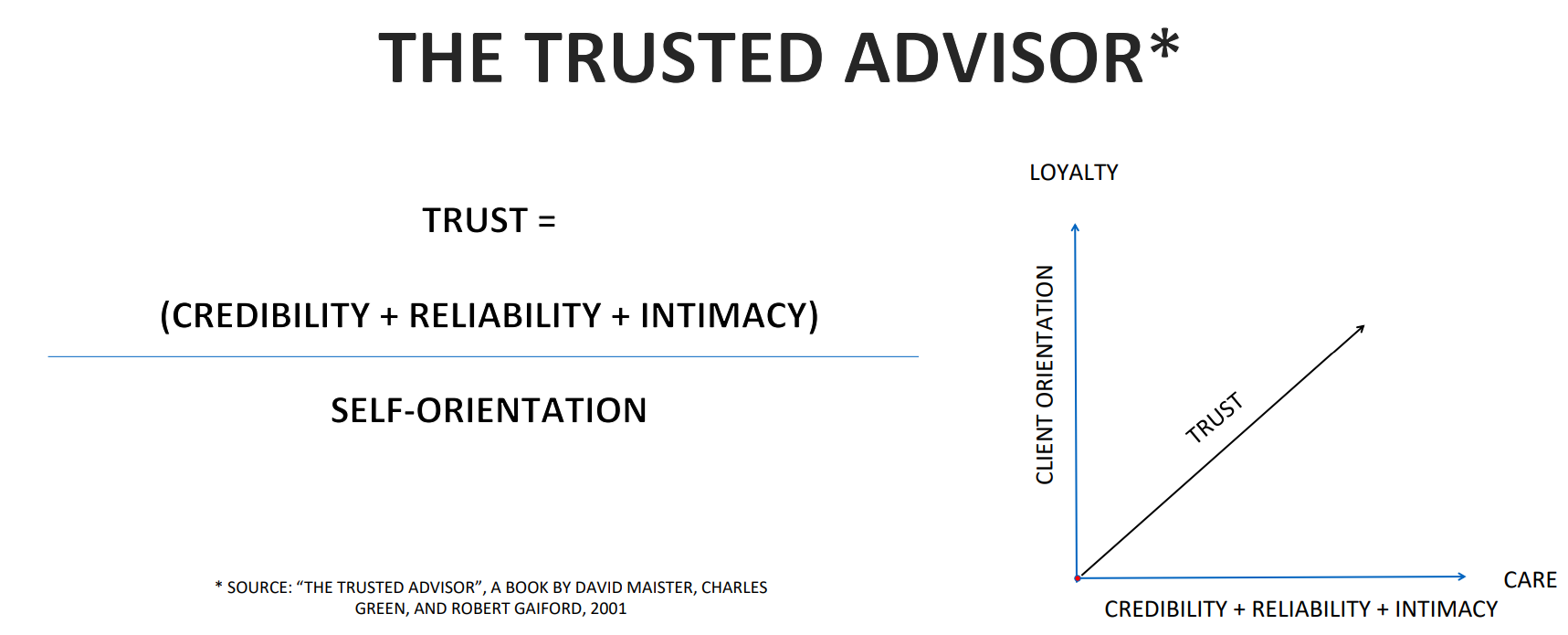

During the webinar, Blaine presented a slide that featured an equation for trust, sourced from The Trusted Advisor, a book by David Maister, Charles Green, and Robert Gaiford, 2001.

I AM A NERD!

The moment I saw the following slide, I knew I wanted to write about it!

Warning #2: If you don’t enjoy math to some degree, you may want to stop reading at this point. There are plenty of posts out there that you will enjoy a lot more!

The Variables

The trust equation tells us that one’s level of trust is a function of ones: Credibility, Reliability, Intimacy and Self-Orientation.

Let’s break down the variables, shall we?

- Credibility is the quality or power of inspiring belief. One can be credible or not credible, but when it come to the idea of credibility, we can establish that credibility itself, cannot be a negative value. Further, someone can have zero credibility.

-

Reliability can be defined as the quality or state of being reliable…. -_- As an aside, I hate when a definition includes the root word. Apparently, Merriam-Webster does not share my frustration. Let’s go with definition number 2. Reliability is the extent to which an experiment, test, or measuring procedure yields the same results on repeated trials. Better! By applying similar logic as we did to Credibility, we see that someone is either reliable or un reliable, but the idea of reliability cannot be a negative value… And as sure as you are living, you know someone who has 0 reliability.

-