Stable Value Funds Due Diligence Guide

Posted by Tyler Kirkland, AIF®, PPC®, Director of Business Development and Client Engagement on March 01, 2019

Recently I hosted a webinar on Fi360's Stable Value Vision – a software solution which allows for the side-by-side evaluation of stable value funds. The output of the product provides a detailed comparative analysis of most stable value offerings.

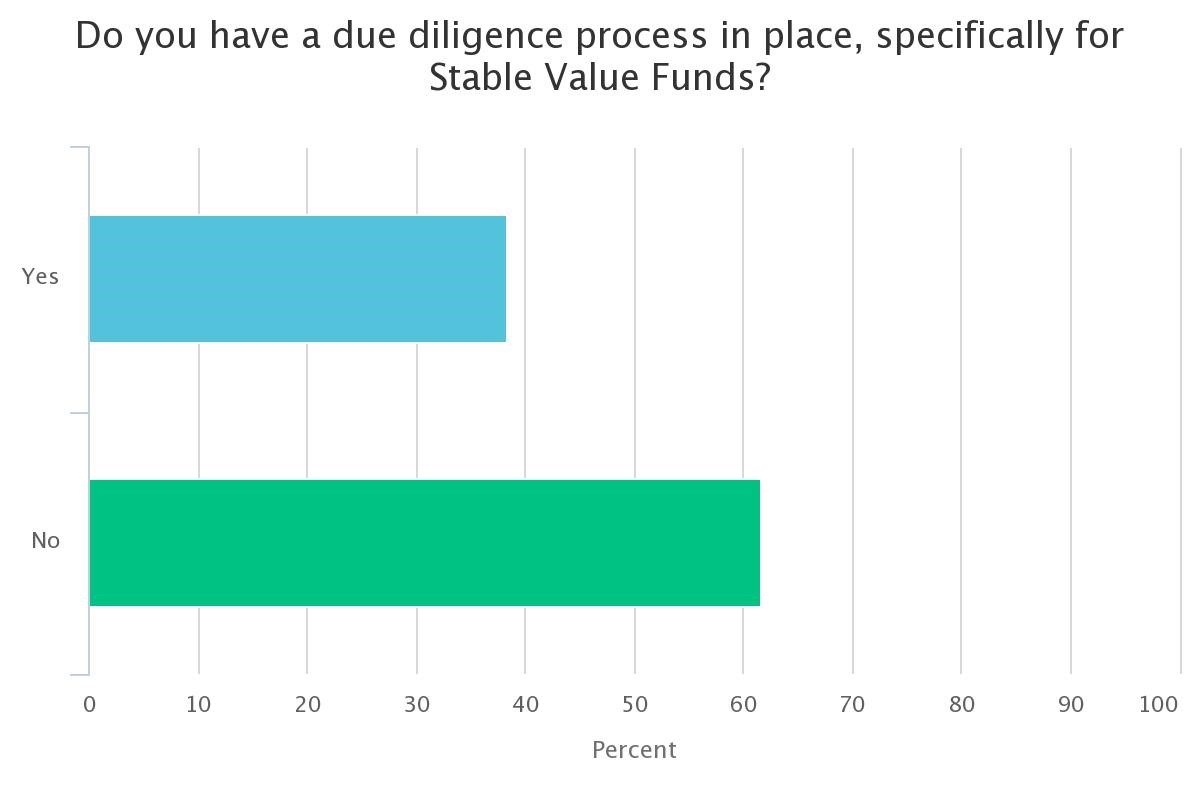

During the webinar, the following poll was conducted. It was discovered that the majority of those who participated in the poll did not have a well-defined due diligence process for stable value funds.

Is this a big deal? In typical Tyler fashion, allow me to sarcastically answer your question with a question….

Is it okay to tell a client that you have a have a process put in place to conduct due diligence on MOST of the investments in their fund line-up, but not all?

Without a well-documented process for fund selection and monitoring, for all fund types, you are at risk!

Stable Value Fund Basics

To review, stable value funds are designed to help you preserve capital while generating returns that are consistent with what you can get from fixed-income investments. In other words, be an investment product that doesn't lose value and provides a solid return.

Stable value funds have diversified portfolios of fixed-income securities that closely resemble what you'd find in a typical bond fund but take an additional step to protect their investors from interest rate fluctuations. Specifically, stable value funds enter into contracts with banks or insurance companies that are specifically designed to offer rate protection.

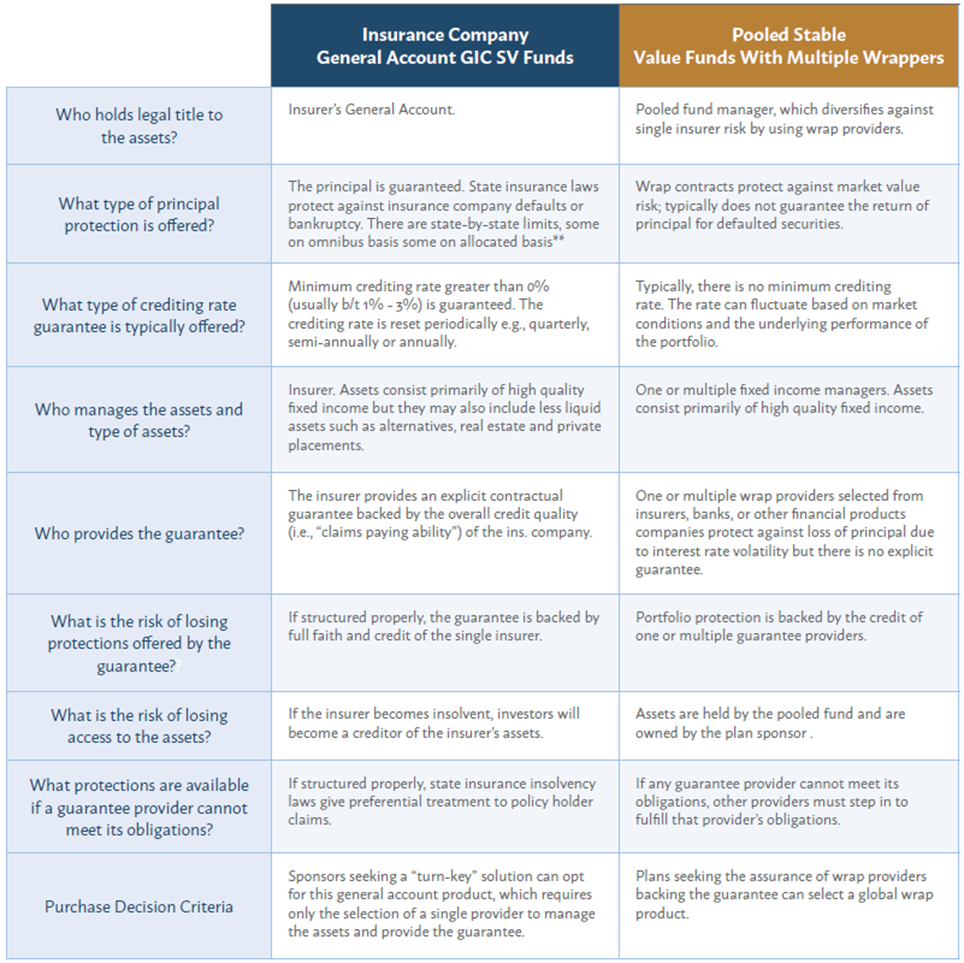

There are two (2) main types of stable value funds. See the image below for details.

The Six Keys

We take into consideration 6 key areas in evaluating and comparing stable value products:

- Transparency - What am I buying?

- Flexibility - What are my options?

- Fund Structure - How does it work?

- Management - Are the managers qualified?

- Value - What does it cost?

- Performance - What is my return?

As you read on, you will discover 21 datapoints that can be used in your stable value fund due diligence process. I say can because depending on the type of stable value fund you are evaluating; some criteria won’t apply. All the data points below are featured in Fi360's Stable Value Vision software.

Transparency

When evaluating the transparency of a stable value fund, the following points should be considered:

- Does the fund disclose its crediting rate formula or spread earned on assets? Put another way, does the investment manager provide specific information on how the return to investors is calculated?

- Crediting rate determines interest rate applied to the book value of a stable value investment contract.

- The spread is where the investments generate more in profit than the cost of deposits and is a source of income for some product manufacturers.

- Who/what is the determiner of the crediting rate?

- The manager?

- A function of the capital markets?

- A function of a portfolio of investments?

- Does there exist a crediting rate floor for this fund?

- Insurance Company General Account GIC Stable Value Funds have a minimum crediting rate greater than 0 percent, usually between 1 percent and 3 percent. The crediting rate is reset periodically e.g., quarterly, semi-annually or annually.

- Pooled Stable Value Funds with Multiple Wrappers typically, do not have a minimum crediting rate. The rate can fluctuate based on market conditions and the underlying performance of the portfolio.

Flexibility

Flexibility, as it pertains to stable value funds, should take into consideration the included points. As this section can get a bit complicated, allow me to expand on these concepts.

- What is the maximum acceptable put provision that you will accept in a stable value fund?

- A put provision is the amount of time required to pass before a plan can exit (resell) a stable value fund at book value.

- When investing in a GIC, a plan may be more restricted than the sponsor realizes, specifically with regards to the “Put Provision”, and most funds offer two options:

- The first is an immediate payout based on a lesser of book or market value. Depending on the market-to-book ratio and interest rates, the stable value fund could pay out less to participants than current book value.

- The second discontinuance option is usually a 1-year or 5-year “put” option. This option means that the plan will receive its assets over a 1- or 5-year period, which is a long time to worry about participants transacting out of the fund. Additionally, during this 5-year period, some contracts become “non-benefit responsive”, meaning that they will not allow participants to redeem during this period.

- Review of the “Put” provision and how it works – This is critical as most plan sponsors don’t understand this.

- Does the fund contain a competing fund provision?

- You are essentially evaluating if it is okay for the fund to restrict certain investment types from being represented in the plan's investment menu.

- There was a time in the stable value industry when the term “competing fund” almost always referred to one thing: a money market fund. No longer!

- Does the fund contain an equity wash provision?

- Here, you are establishing whether or not it is okay for the stable value fund to require transfers from the stable value product to a competing option to be “washed” or directed to another investment option not designated as a competing option for a period of time.

- Equity washes usually last 90-days

Fund Structure

This section’s criteria are dependent on the type of stable value product you are evaluating. I have expanded on the topics I thought needed some further elaboration.

Things to consider:

- The number of wrap providers

- These providers are offering wrap contracts

- Stable value investment contract that “wraps” a designated portfolio of associated assets within a stable value investment option to provide an assurance of:

- Principal and accumulated interest for that portfolio

- Payment of an interest rate

- Stable value investment contract that “wraps” a designated portfolio of associated assets within a stable value investment option to provide an assurance of:

- Wrap contracts can be issued by banks, insurance companies, or other financial institutions.

- These providers are offering wrap contracts

- The average wrap provider credit rating

- Each wrap provider has a credit rating. This is an evaluation of the credit risk predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting.

- Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

- The number of investment managers

- The credit quality of the underlying fixed income portfolio

- The portfolio duration

- Your desired portfolio sector concentration

- Your desired allocation to cash of the portfolio

Management

The things to consider from a managerial perspective for Stable Value funds are pretty standard, relative to other investment product types:

- Manager Tenure

- Minimum Fund Size (AUM)

Value

When questioning the cost of a stable value fund, keep an eye on both of the following points:

- Expense Ratio - A fund’s operating expenses expressed as a percentage of average net assets.

- All-In Expense Ratio - The total cost of the overall product, also known as the gross expense ratio, that includes all investment management fees, insurance company wrap fees, administrative fees, revenue sharing, and any other applicable fees that an investor would pay for the product.

Stable value fees can be confusing. For certain types of products, like the pooled, fees are expressed as an expense ratio making it easy to compare products. For other types of products like traditional insurance company general account products, the underlying costs are not reported as an expense ratio.

If you don’t see an explicit cost, then you can assume that the fees – whatever they happen to be – are being netted out of the gross return. You will want to ask for a detailed breakout of fees in order to help your client to make an informed buying decision and document this request.

Performance

When it comes to the performance of stable value funds, paying attention to standard performance metrics is important. We include:

- 1-Year Performance

- 3 -Year Performance

For those seeking long-term capital appreciation, stable value funds won't provide the level of growth most people need to achieve their retirement goals. However, as a component of a balanced portfolio that includes more growth-oriented investments, stable value funds can reduce overall portfolio risk while avoiding some of the key pitfalls of many fixed-income investment options.

Although unlikely, it is possible to lose money by investing in a stable value fund. Knowing how to identify a “good” stable value product can also minimize the chance for loss.

You should also consider the following, in addition to returns:

- Does this fund have an acceptable market-to-book ratio?

- The market-to-book ratio seeks to evaluate whether the product is over or undervalued by comparing its book value and its market value.

- The market value, at any point in time, is determined by the financial marketplace.

- The book value, in contrast, is the net asset value.

- A ratio higher than 100 is preferable as a ratio lower than 100 indicates that the value of the investments has fallen below the dollar amount contributed by participants, or the book value. Participants who are withdrawing cash from the fund are now relying on the insurer to cover the difference between market value and the book value of the total contributions.

- The market-to-book ratio seeks to evaluate whether the product is over or undervalued by comparing its book value and its market value.

- Does the fund have an acceptable crediting rate?

- Mentioned previously, the crediting rate determines interest rate applied to the book value of a stable value investment contract, typically expressed as an effective annual yield.

- As provided in the investment contract, the crediting rate may remain fixed for the term of the contract or may be “reset” at predetermined intervals.

Resources!

To continue your education on stable value funds, here are some additional resources that you may find useful:

The Takeaway

“Is one of the stable value product designs fundamentally better than the other”? The short answer is ‘NO’!

The takeaway here is that if you follow a due diligence process you can recommend either product type.

If you'd like set up a demo of Fi360 Stable Value Vision, contact sales@fi360.com, call 866-390-5080 or join us on Tuesday, March 5 for a webinar. You are now one step closer to being a Super Fiduciary!