The Department of Labor’s Prohibited Transaction Exemption (PTE) 2020-02, SEC’s Regulation Best Interest (Reg. BI) and the fiduciary standard for investment advisers under the Investment Advisers Act (the “IA fiduciary standard”) impose strict requirements when making account recommendations to retail investors, including those relating to IRA rollovers and transfers.1 Complying with the PTE, Reg. BI and the IA fiduciary standard involves specific documentation, oversight practices, client communication, and more.

To keep current with these new and evolving requirements, Decision Optimizer comes with the independent expertise of the Pension Resource Institute (PRI). PRI monitors changes in legislation, regulation, sub-regulatory guidance and even trends in enforcement and litigation to help ensure the inputs and outputs of Decision Optimizer are properly configured to promote compliance while managing risks to the fullest extent possible.

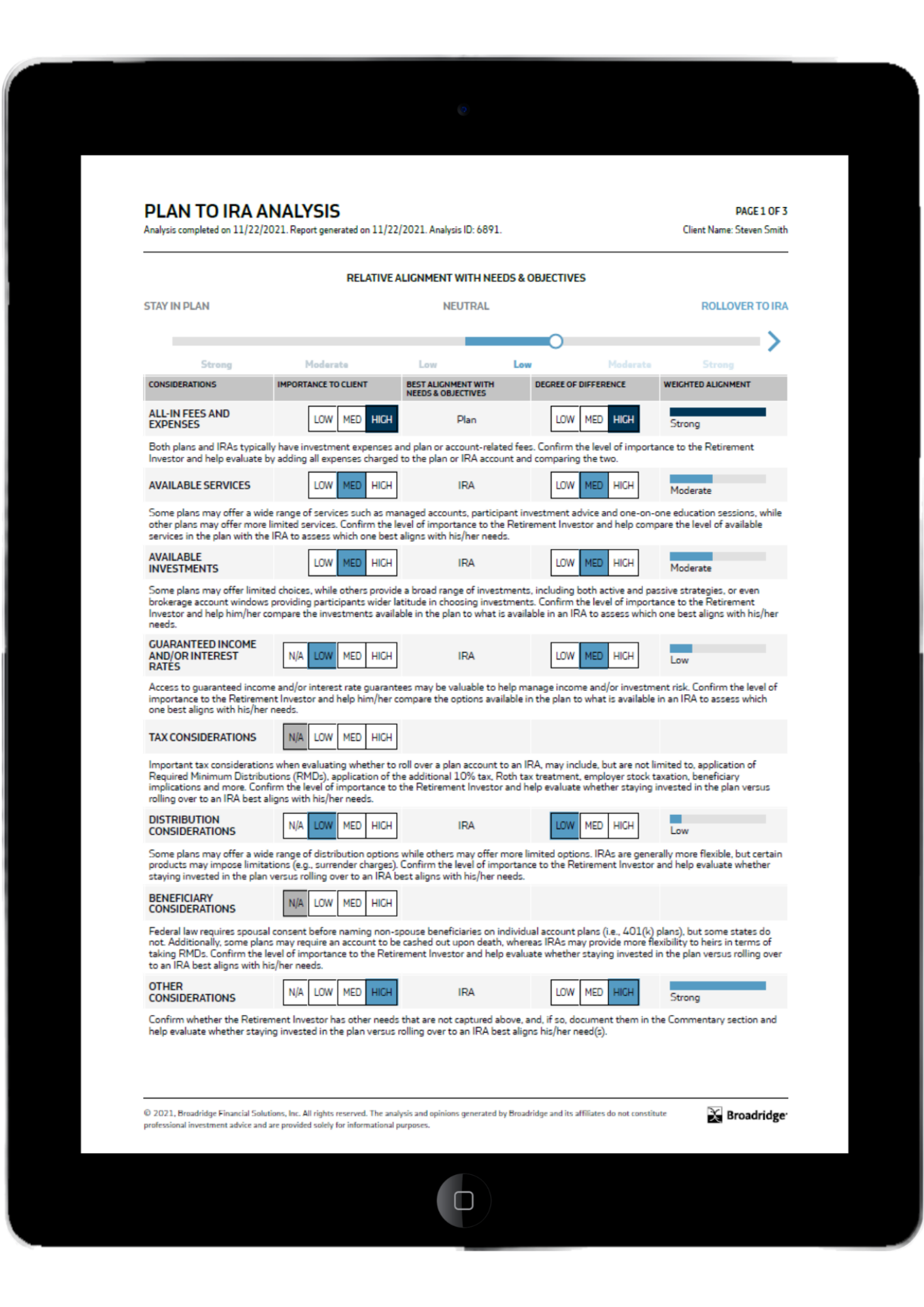

Firms of all sizes can count on Decision Optimizer either out-of-the-box or configured based on firm needs and financial professional preference. The user-friendly interface meets PTE 2020-02, Reg. BI and the IA fiduciary standard requirements for account comparison, while minimizing the disruption to your firm’s current account opening protocols.

Your firm can choose to leverage PRI's written best practices as-is or customize the specifics to fit your firm's unique needs. Either way, you will have the resources and support to comply with PTE 2020-02 as well as Reg. BI and the IA fiduciary standard’s account selection criteria in a practical and streamlined way.

Highlights of Decision Optimizer include:

-

Subscriptions available for advisors that operate independently or as part of an enterprise

-

A single workflow, with customizable criteria for evaluating ERISA Plan and IRA rollovers, transfers and changes to account type

-

Access to robust benchmarking data when actual plan documentation isn't available

-

Interactive financial professional interface with real-time updates

-

Documentation of recommendations and client-friendly reports

-

The ability to include investor needs and current account features to the analysis to support the recommendation and to generate or suppress client-facing output based upon the decision framework or use case

Decision Optimizer promotes automation and efficiency

Information can automatically be sent to other applications through webhook capability:

-

Data collected in the analysis can be shared to a CRM or similar application

-

The PDF report can be sent to an application for storage, e-signature, or to be emailed to client

Technology Provider | Compliance

Beyond the Decision Optimizer Software

Plan Benchmark Data

When actual 401k plan data isn’t available, advisors need a reliable benchmark. Our methodology leverages aggregated, anonymized data associated with over 300k plans with over $1trillion in AUM and RFP insights; ensuring a reliable benchmark is available when alternative data such as the Form 5500 is incomplete.

Oversight

Data from all analyses completed in our Decision Optimizer flow into our enterprise business intelligence tool. This allows home office personnel to easily sample transactions, identify outliers and complete retrospective reviews through a single supervisory dashboard.

Training & Education

Various forms of training, on both the regulation and our solution, are available for enterprise clients. Fi360 and PRI are collaborating on these training courses in the context of our long-term partnership. Our learning management system allows for tracking of advisors trained (including requiring a quiz to pass if desired).

1See e.g., SEC Staff Bulletin: Standards of Conduct for Broker-Dealers and Investment Advisers Account Recommendations for Retail Investors available at: https://www.sec.gov/tm/iabd-staff-bulletin.

Let’s get started!

Fill out the form below and a member of the Fi360 team will be in touch.