Conformity Is Not the End: Introduction

Posted by Tyler Kirkland, AIF®, PPC®, Director of Business Development and Client Engagement on May 22, 2018

Conforming to the Fiduciary Standard

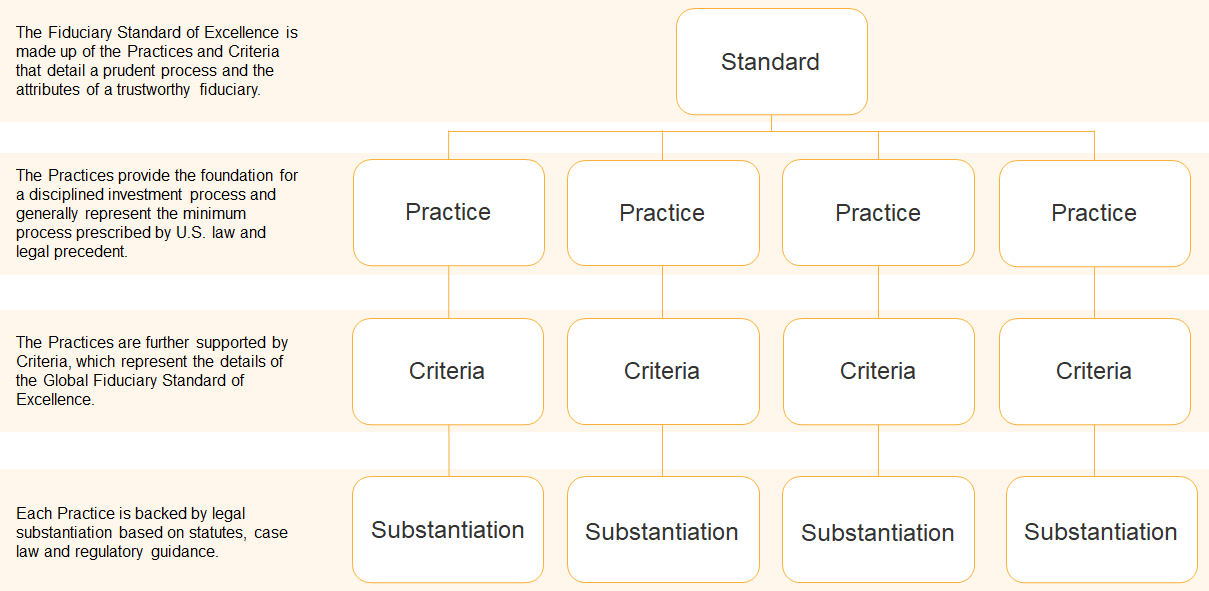

Adherence to a standard can be the foundation for trust… and what good is the financial services industry without trust? Standards provide a framework for consistency, risk management and increased efficiency and effectiveness.

At Fi360, the Prudent Practices® are organized under a four-step Fiduciary Quality Management System (FQMS). The steps are consistent with the global ISO 9000 Quality Management System standard, which emphasizes continual improvement to a decision-making process. In other words, meeting the standards is only the first part of implementing the system.

Step 1: Organize

During the organize stage, the investment fiduciary identifies laws, governing documents, and other sources of guidance for fiduciary conduct.

Step 2: Formalize

During the formalize stage, the investment fiduciary identifies the substantive investment objectives and constraints, formulates asset allocation strategies and adopts an investment policy statement to guide the investment decision-making process.

Step 3: Implement

The implement stage is when investment and service provider due diligence is performed and decisions about investment safe harbors are made.

Step 4: Monitor

During the monitoring stage, the investment fiduciary engages in periodic reviews to ensure that the investment objectives and constraints are being met and that the Prudent Practices® are consistently applied.

As time goes on, the number of people conforming to The Standard continues to increase. With so many financial intermediaries following a higher code of conduct, does an individual’s competitive edge dull? Maybe mass conformity isn’t such a good idea…

Raising the Bar

This is the basic principle of progress. When the novelty becomes the norm, there is pressure to innovate. Therefore, conformity to elevated standards is simply the catalyst for growth.

If everyone is operating at a high standard the only way to establish differentiation is by adding more value than your peers. But how?

- Define your client service strategy goals and success metrics

- Develop your client service value proposition

- Design the service strategy

- Client segments

- Client team structure

- Team roles

- Services by segment

- Define the client experience; develop an implementation plan

Throughout this series, I will walk you through how you can raise the bar with an Effective Client Services Strategy. If you’re already doing the right thing when it comes to in the investment management process, you can add value for your clients and continue to delight them, making them clients for life!

Continuous Improvement

In both the FQMS and a client services strategy, an iterative process is applicable and almost necessary.

As a matter of fact, Practice 4.5 from the Prudent Practice Handbook for Investment Advisors reads:

There is a process to periodically review an organization’s effectiveness in meeting its fiduciary responsibilities.

This practice and its underlying criteria challenge complacency. Just because you conform to the practice once does not imply the work is done.

Through regular assessments you can identify:

- Conformities to fiduciary best practices;

- Non-conformities to the same;

- And opportunities for improvement.

An honest reflection of what worked and what didn’t will only empower you to exceed the expectations of your clients, your peers and even yourself.

P.S. For more information on the Fiduciary Standard of Excellence, the Fiduciary Quality Management System and the benefits of regular assessment, check out our Learning and Development Solutions.