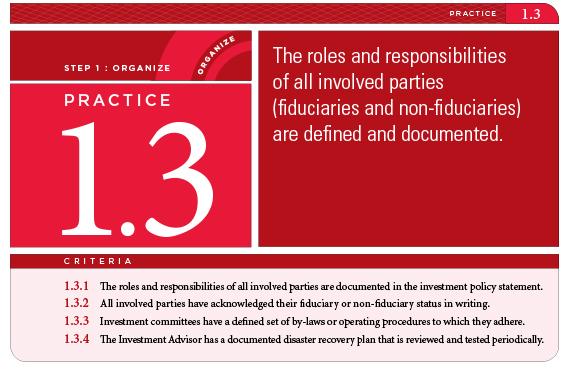

Practice 1.3: Roles & Responsibilities of all Involved Parties are Defined & Documented

Posted by on December 18, 2013

For any type of portfolio, it is essential that the various parties involved in the investment process are working in coordination with each other and have a clear understanding of where their individual roles and responsibilities begin and end. Unfortunately, it is too often the case that parties are either unaware of the full extent of their responsibilities or have misunderstandings about the responsibilities of others. For this reason, the third Practice in a prudent investment process is to ensure each party involved is identified, their role is defined and documented, and they have acknowledged their role in writing. Let's take a look at the Practice and associated Criteria:

It is not uncommon for some investment fiduciaries to be unaware of their status and liability when working with investment portfolios. This is particularly true among investment stewards, such as plan sponsors and trustees, who will ultimately be held responsible for ensuring all duties are being fulfilled. They often have no investment or fiduciary training and lack awareness of the full scope of their responsibilities. Similarly, stewards often mistakenly assume certain service providers, such as advisors, must always act in their interests. Even though most advisors may be acting ethically and appropriately, it is still important that the stewards and everyone else, for that matter, clearly understands who is legally required to act as a fiduciary and who is not. Ignorance is not a viable excuse when it results in a fiduciary breach.

As we briefly touched on in Practice 1.2, the investment policy statement is the essential governing document and serves as the business plan for how a portfolio is to be managed. As such, it should include information about the roles and responsibilities of the parties involved in the portfolio, including:

- The responsibilities of the stewards and, in the case of an institutional portfolio, the role of the investment committee or other parties acting in a fiduciary capacity for the investment steward

- The role of the Investment Advisor

- The role of the custodian

- The role of the separate account or alternative investment (e.g., hedge fund) manager(s), if any

- Instructions for each money manager, including: (a) securities guidelines, (b) responsibility to seek best price and execution on trading the securities, (c) responsibility to account for soft dollars (if applicable), and (d) responsibility to vote all proxies

- The role of the recordkeeper

- The role of the investment consultant

In addition to the benefits of clarity, documentation also helps to ensure continuity of the investment strategy when there is a change to any of the parties and to prevent gaps where certain essential functions are not being performed for the portfolio. If the IPS defines a complete process consistent with the Practices and individuals are assigned to and acknowledge the requisite roles for executing that process, then confusion should be at a minimum and the portfolio should benefit from an efficient investment management process.

Likewise, other mechanisms for ensuring clear and consistent management processes should also be employed. For instance, committees should have defined by-laws and operating procedures and Investment Advisors should maintain a disaster recovery plan for the investment firm.

For more information on defining roles and responsibilities, check out the following resources:

- fi360's Prudent Practices handbooks. These handbooks define and elaborate on the Practices that are the subject of this blog post and the Spotlight on Practices series. At the end of each Practice in the handbook, you will find citations to the various legal codes where the requirements that substantiate a Practice can be found.

- fi360 provides samples and templates of some of the documents used to define roles and responsibilities

- IPS AdvisorPro, a technology solution for building and managing client investment policy statements.

- ERISA plans have specific requirements for identifying or disclosing responsibilities and fiduciary status. AIF and AIFA Designees have access to certain templates built to facilitate these obligations. These documents can be found in the Designee Portal.

* * * * *

Editor's Note: This post was originally published in December 2009. It has been updated to reflect the 2013 update to the Prudent Practices. The Spotlight on Practices series highlights each of the Prudent Practices for Investment Fiduciaries. To learn more about the Practices, click "Spotlight on Practices" link in the categories list or visit the Practices section on fi360.com. If you have any questions or comments, leave them in the comments section below each post, or email us at blog@fi360.com.